One of the things people miss most about life before the COVID-19 crisis is, without question, traveling. The travel industry has been hit hard by the effects of the pandemic and people continue to be unsure about their future travel plans. No one knows when travel regulations around the world will be lifted and when it will be safe again to travel globally. Nevertheless, our latest study results indicate that people can’t wait to travel and there is considerable pent-up “travel revenge” demand ready to come in 2021. Now it’s up to the travel industry to get prepared.

At the beginning of 2020, the COVID-19 crisis plunged the world into chaos. Now, nearly one year later, we are still living with the impacts of the pandemic on our daily lives. The travel industry has been among the hardest hit with hotels being shut down and air travel dropping dramatically. According to the World Tourism Organization (UNWTO) the travel industry lost 320 billion US dollars in international tourism receipts in the first five months of 2020. With the first wave of vaccinations having started around the globe at the end of last year, people are starting to think about possible vacation plans in 2021. In December 2020, Simon-Kucher & Partners and ROIRocket, a leading provider of research services, conducted the Travel Trends 2021 Study. We surveyed more than 3,900 people across France, Germany, Spain, the United Kingdom, and the United States about their travel and booking intentions for 2021.

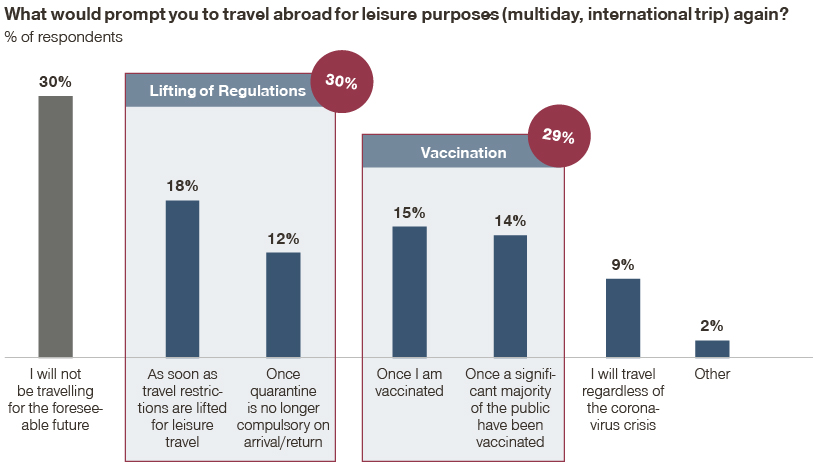

The study revealed that the majority of leisure travelers expect to travel again in 2021 (57 percent), primarily during the second half of the year. Among the remaining travelers, uncertainty prevails: one in four respondents does not know when they will travel again. The study also proves that a crucial factor in travelers’ decisions on when to take their next trip is not only the lift of regulations (30 percent), but also the prevalence of inoculation: 29 percent want to travel when either they or the majority of the public is vaccinated.

Majority of travelers maintain travel budgets – Income uncertainty as main driver for travel budget decreases

Our study results show that 70 percent of travelers will spend the same amount of money or even more on travel in 2021 than before the pandemic. The reason? Demand has been pent up, and people are eager to get out again. Countries like Germany stand out as the number of travelers keeping their budget stable or increasing it is even higher at 81 percent, increasing the country’s attractiveness as a source market. Although a lot of people can’t wait to travel and visit other countries again, there are around 30 percent of respondents who are planning to spend less on travel after the COVID-19 crisis. Country-specific views vary from only 19 percent in Germany to up to 42 percent in Spain.

Out of the travelers with decreased travel budgets, 52 percent indicated that uncertainty around employment status and income is the primary reason for the cutbacks on spending, and 23 percent said that they expect to spend less in case the trip gets cancelled. These numbers show that there is no fundamental shift away from travel, but rather a temporary decline due to limited or uncertain disposable income and uncertainty in general.

Considering all these opportunities, but also challenges lying ahead, travel and tourism companies need to set out their commercial strategy and try to be agile enough to respond to the travel rebound anticipated when lockdowns are eased and a relevant share of the population is inoculated.

“Revenge travelers” are ready and waiting in the wings

The “revenge travel” trend has already been observed in parts of Asia, where virus-related regulations have started to be lifted. An example is China: according to Bloomberg, during the Golden Week Holiday in October 2020 holiday travel has returned to more than 80 percent of the pre-pandemic levels in 2019 - a promising recovery in light of the current situation. Across all consumers surveyed, approximately 10 percent currently fall into this segment of revenge travelers, and that number could grow. Revenge travelers are ready, willing to travel, and aim to spend more than before - the industry needs to be prepared for them.

From this segment, travel companies can expect not even more bookings but also an increase in length of stay: Across all surveyed countries, 52 percent of revenge travelers plan one larger trip, while 48 percent plan smaller, more frequent trips. In general, revenge travelers are willing to spend more on accommodation and food and beverages when they start travelling again, a good sign for hospitality players like hoteliers and restaurant owners.

Travelers in a post-pandemic world

A lot of us can hardly wait to be out in the world again and explore foreign cities, leaving our quarantine cave behind, if just for a little while. For much of 2020 many people traveled closer to home, if at all: this staycation trend will not be going away. People are yearning to go on holiday, but they are still uncertain about travel plans as the pandemic drama continues. Staying closer to home appears to be a safe and fairly attractive option that had previously been overlooked a lot.

Overall, 39 percent of respondents expect to travel more domestically versus before the pandemic and around 49 percent will travel less internationally. However, comparing these results with a comparable study conducted in May 2020 indicates that a positive development for international travel is visible.

With regards to holiday transport modes, 46 percent of travelers will opt more for private cars, while 47 percent will travel less by air and 42 percent will travel less by train. The cruise industry faces a decreased demand with 56 percent stating they will go on fewer cruises than before COVID-19.

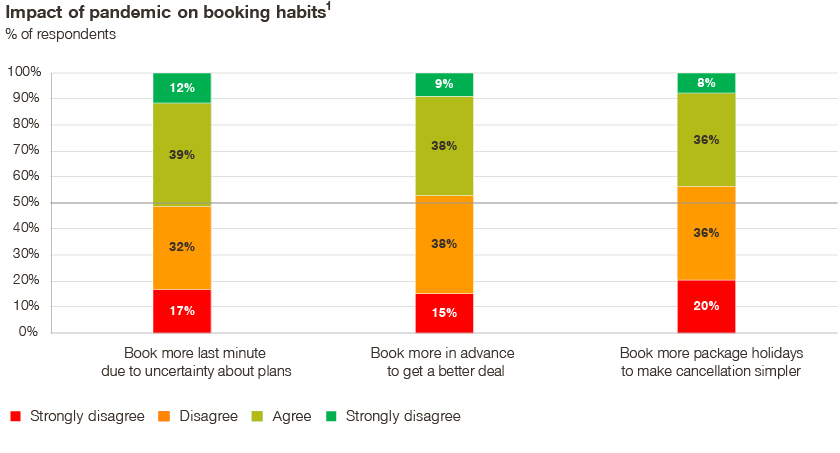

Booking behavior will also have seen lasting impacts: On the one hand, 51 percent of travelers surveyed plan to book more last minute because of the uncertainty. On the other hand, 47 percent plan to book earlier to benefit from price advantages. This split in tendency fits with the fact that 76 percent of travelers expect promotions and discounts after the pandemic to boost demand.

Especially package holidays, offering simple cancelation options, are on the rise (+44 percent). People are unsure and anything that helps them in being flexible in their planning will be highly appreciated by travelers and therefore sought after.

Considering all observed changes in customer behavior, travel companies need to offer strong incentives and structures that entice early bookings, while reassuring travelers that they have the flexibility to cancel or change their plans if the need arises. By granting customers more booking flexibility alongside attractive incentives, the travel industry will be able to appeal to the “pent-up” demand of travelers and ensure more bookings in 2021.

To find out more about the study results, please reach out to the authors!