It is no secret that recent times have been tough for the software industry. Growth rates have plummeted, and profitability has barely increased. Less growth at the expense of improved profitability can be an acceptable trade-off. However, this combination of decreasing growth and stable profitability emphasizes the challenges the industry is currently facing.

These challenges include rising interest rates, unprecedented inflation rates, and labor shortages. In Simon-Kucher’s Global Software Study, using a panel of over 500 B2B SaaS executives, respondents reported an average revenue growth rate below 10% in 2022. This is in stark contrast to the results from 2020 where 40% reported a growth rate above 20%.

Though, as we move into the fourth quarter, we can see inflation and interest rates stabilizing, signaling that the macro-economic conditions for the software industry have improved. As conditions are improving, SaaS companies are able focus on future growth again. The Global Software Study shows an outlook for 2023 that is moderately positive with respondents expecting to close this year with a higher average revenue growth that is twice as high compared to 2022. However, this is still significantly lower compared to 2020. There is a group of best-in-class B2B SaaS companies in the sample that have structurally outperformed their peers in terms of revenue growth. These have achieved above average growth of more than 10% in 2022 and are expecting to continue at a growth rate that is 50% higher than the average. What’s at the top of their agenda? We see these best-in-class B2B SaaS companies are prioritizing growth through digital transformation, organic growth, new product development and pricing excellence.

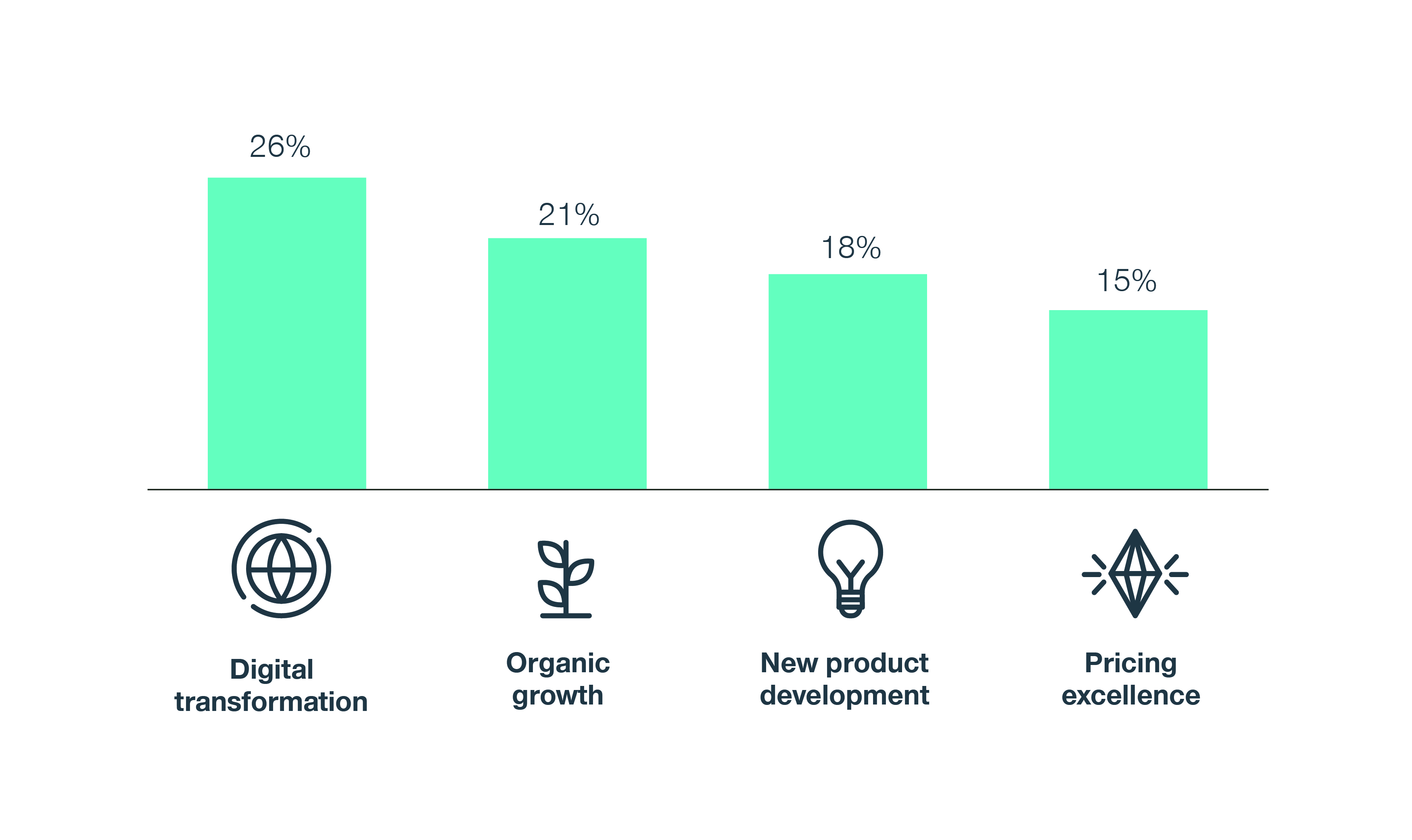

4 top priorities on management agendas to return to growth

The top priorities on the management agendas of the best-in-class B2B SaaS companies are digital transformation, organic growth, new product development and pricing. It is worth noting that in these topics for example cost-cutting and inorganic growth did not make it to the top, indicating confidence in a company’s current capabilities develop itself through profitable revenue growth. Let’s dive deeper into what these top four priorities mean and why they earn their place on the management agendas of these top performers.

Figure 1: percentage of points awarded to top strategic topics. Question: How is your management team’s attention divided across each of the activities shown below? Please allocate 100 points across these activities, based on the amount of attention management focuses on each activity.

1. Digital transformation

We see that this is not only transitioning to a cloud or implementation automation, but also commercial digitalization such as how to use digital to sell better, win more customers, inspire more customers, or set better prices through algorithms. A way to accomplish this is for instance to develop a self-serve portal for smaller customers and improve the personal approach for larger or highly strategic customers. This solution ensures that sales use their time only for the most valuable clients. Simon-Kucher digitalization projects typically increase profitability between 100 and 500 base points.

2. Organic growth

Organic growth consists of two parts: new customer acquisition and growing with current customers. New customer acquisition requires companies to optimally enable their sales teams through sales excellence. This means providing your sales team with the necessary materials and tooling to, for example, optimally convey the value of the product, efficiently convert prospects into customers, and prepare them for hard negotiations. Sales excellence typically ensures 10-15 ppt more revenue growth.

Given the current macro-economic climate and the reduced demand that this resulted in, companies need to give more importance to growing with current customers than before. We see that customer success teams are increasingly equipped to support sales with sophisticated upsell and retention programs. The best SaaS companies can grow over 30% in revenue from their customer base alone.

3. New product development

A common mistake is to monetize features that took a lot of work and not monetize the ones that were simple to make. Ideally, when the product development roadmap is informed by customer needs and willingness-to-pay, new products should either drive more volume or lead to new monetization potential. It is key to always consider whether new product development can drive upsell. For companies with a good-better-best pricing structure, it is worthwhile to consider whether a new feature can drive up-sell to better or best packages, while for companies with usage-based pricing up-sell can also mean creating features which stimulate product usage.

4. Pricing excellence

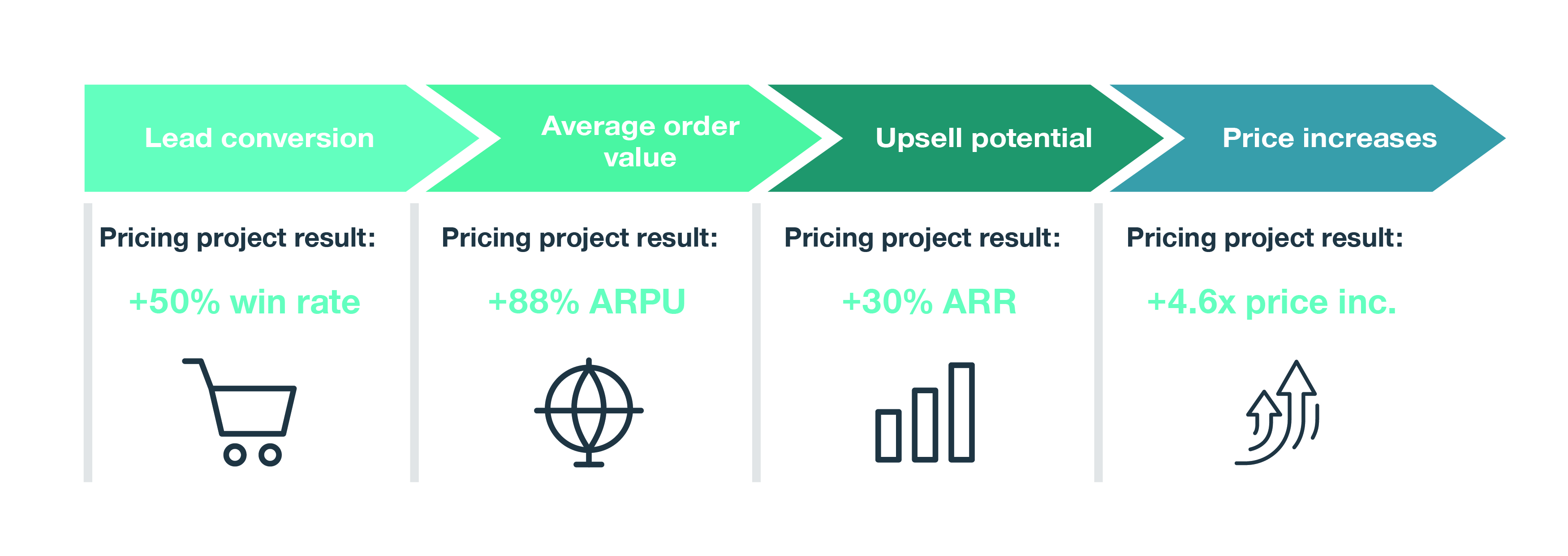

A 5% increase in prices is much more valuable than a 5% decrease in costs, as price increases impact revenue and cost decreases only impact costs, which are smaller than revenue. The best-in-class B2B SaaS companies from the Global Software Study consider pricing 30% more important than cost cutting. This emphasizes the importance of the pricing lever. Pricing excellence is the core that ties the return to growth together. Pricing excellence includes the optimal offering structure to grow with your customers through up- and cross-sell. A typical pricing excellence initiative enables customer growth throughout the entire customer lifecycle. Pricing excellence should also include systematic price increases which have become standard practice today. These price increases should be targeted to minimize churn.

Figure 2. Simon-Kucher packaging & pricing solutions enables sustainable revenue growth throughout the entire customer lifecycle.

Look ahead and focus on future growth

In conclusion, after recent challenges companies look ahead with optimism and a focus on future growth. The best-in-class B2B SaaS companies in terms of revenue growth have 4 top priorities on their management agenda. First and highest priority is digital transformation of sales which can boost profitability by 100 to 500 base points by for example freeing up time for your sales team to focus on high value interactions with customers. Second priority on the list is organic growth, where the best B2B SaaS companies have the potential to improve ARR by 30% with their current customer base only. Third priority on the list would be new product development, which unlocks new upsell opportunities. Finally, the best-in-class B2B SaaS companies prioritize pricing excellence. Pricing excellence allows you to grow throughout the entire customer lifecycle, from winning +50% more projects to improving the results of your price increases by 4.6 times.

We support our clients on all the above-mentioned topics, from providing our own software to support your digital transformation to helping you implement the next price increase. Interested in how we can support you on these topics and set the first step in improving your growth? Feel free to contact us.

The authors wish to thank Roos Offerhaus (Manager) and Pepijn van Eerten (Senior Consultant) for their contribution to this article.