Regardless of whether economies enter technical recessions, B2B companies must be prepared to navigate the land of prolonged slowdown in demand.

A muted outlook is ahead

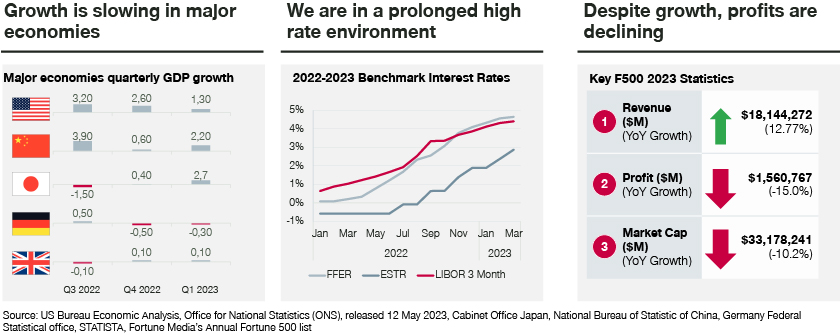

The post-COVID party is over. As governments continue to tackle sluggish inflation and stubborn labor markets, the implications on the economy are now clear. Major economies are at risk of a recession, with Germany entering a technical recession this past quarter. Once hopeful markets are gradually accepting a prolonged interest rate environment with long-term dampening of end consumer demand, burdening companies with increasingly high costs of capital and debt service and resulting in suppressed profitability.

Industrial companies should prepare for a prolonged slowdown in demand

Regardless of major economies reaching a recession, by technical definition, a reversion to post-COVID demand and interest rate environments looks continually more distant. Industrial companies should develop a long-term outlook and playbook for dealing with suppressed demand, ongoing labor challenges, and potentially financial distress of customers and suppliers.

Simon-Kucher recommends developing a practical commercial playbook.

Key recommendations

1. Reprioritize and refocus on segments:

Commercial efforts and resources should be deployed on high-value customers with long-term potential. Measures include:

- Profitability

- Tenure and forward business risk

- Potential business

- Strategic importance

2. Offer price alternatives:

Using price as a unilateral response to compressed budgets and increased price sensitivity is costly. Rather than offer existing value at the same price, we recommend offering a less expensive alternative (LEA) at a lower price. Ideally, cost and value are aligned resulting in minimal margin cannibalization risk. This can result through:

- Debundling of product and service and killing “nice-to-haves”

- Establishing service price lists to balance price and performance

- Reducing performance and offering "good enough" solutions

3. Introduce alternative revenue models:

In a time of rising interest rates, investments in CAPEX become reduced. Companies in the S&P 500 are projected to increase capital spending by an estimated six percent in 2023, compared with an estimated 20 percent increase in 2022. Alternative pricing models can help overcome this obstacle by shifting your customers’ spend from CAPEX to OPEX. Consider the shift to usage-based metrics, however, be mindful of the cash flow implications from transitioning from one-time to recurring revenue.

Conclusion

Complacency will ultimately be the enemy of survival for many businesses. A wait-and-see approach leaves your business outlook at the mercy of policy and central bankers. We implore business managers to begin adjusting their commercial model and take control of their own destiny.

Find out more on how you can navigate market volatility in the Industrials sector.