Many chemicals and materials companies operating at the start of the value chain have started developing sustainable solutions. However, these companies face the unique challenge of added margin in each step of the value chain, making the product prohibitively expensive down the line. By defining and quantifying value at different points of the value chain and engaging in revenue and price model discussions, companies can start to tackle this challenge.

Sustainability has become a paramount consideration for companies due to a combination of push and pull factors. Regulatory (push) measures, such as the Green New Deal and the Fit for 55 package, incentivize the reduction of emissions and drive the business case for greener products. Additionally, our latest Sustainability Study reveals that 71% of global consumers are actively changing their lifestyles to incorporate more sustainable practices. This shift in consumer behavior creates a pull factor for chemicals and materials companies further down the value chain, as they seek to reduce scope 3 emissions and offer more sustainable products.

The challenge: An additional premium charged at each step of the value chain leads to prohibitively expensive products for the end-consumer, and a minor piece of the pie for the innovator

The aforementioned push and pull factors necessitate a reevaluation of strategies and portfolios for chemicals and materials companies. These companies are introducing innovative sustainable alternatives, which often come at higher production or sourcing costs, initially resulting in green premium pricing. However, each link in the value chain tends to charge a similar relative margin on top of the sustainable alternative, resulting in a significant price difference compared to comparable legacy products. This price differential often exceeds the willingness-to-pay of end consumers, causing insufficient adoption and impact on the environment.

We outline five key success factors to successfully monetize sustainable innovations at the start of the value chain.

Success factor 1: Define sustainability value drivers for parties in the chain

The first step is to identify the specific sustainability value drivers that hold significance for stakeholders along the value chain. For example, our research in the polymers sector revealed that recyclability and biodegradability were top priorities, ranking higher than non-sustainability aspects like toxicity and strength, but also sustainability drivers such as bio-based share and GHG emissions.

By understanding the market's exact sustainability value drivers, companies can align their value story and innovation around these factors.

.jpg)

Success factor 2: Identify and prioritize value chain players and customer segments deriving the most value

Not all players in the value chain attach the same level of importance to sustainability value drivers. Currently, intermediate links in the value chain may struggle to recognize and capitalize on the added value of sustainable innovations. However, downstream consumer-facing brands, particularly those committed to reducing scope 3 emissions, tend to be more aware and interested. Mapping the awareness and priorities of stakeholders along the value chain is crucial to determine the segments that will derive the most added value from sustainable innovations. This awareness is expected to move upstream in the future and could be different by industry.

We recommend to first start identifying which links in the chain are set to benefit most from the identified sustainability value drivers. Next, clearly segment these focus links and prioritize your focus segments (e.g. players with high scope 3 reduction targets). By applying these actions companies can ensure their sales efforts are focused only on players most committed to embracing the developed innovations and yield the highest returns in the transition.

Success factor 3: Quantify willingness-to-pay for sustainability for different value chain players

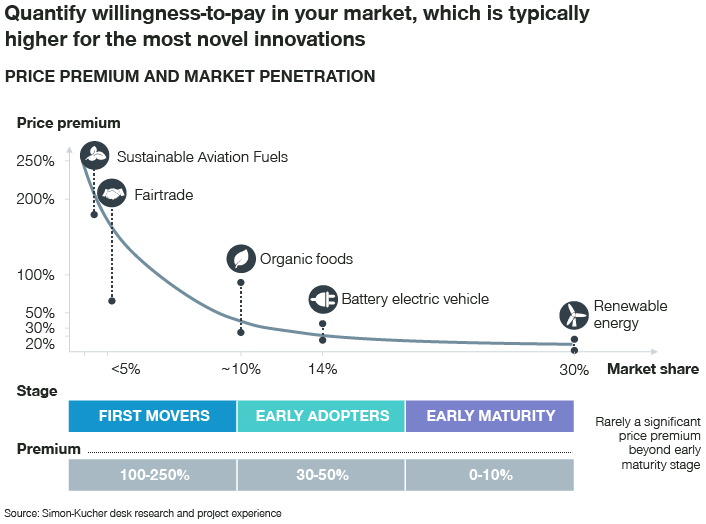

Willingness-to-pay for sustainability-driven innovations varies among different players in the value chain and evolves over time. In the early stages, when sustainable innovations cater to niche audiences, the willingness-to-pay tends to be higher but decreases as adoption becomes more widespread. Defining what constitutes value and which players in the chain benefit most (from the previous two lessons) helps lay a solid foundation for quantifying willingness-to-pay for these players.

A substantial difference in willingness-to-pay along the chain results in a need to target value chain players with a higher willingness-to-pay using a made-to-measure price model. You can quantify willingness-to-pay for sustainable alternatives using a mixed-method approach such as surveys and interviews as well as quantification of ETS benefits.

Success factor 4: Innovate price and revenue models

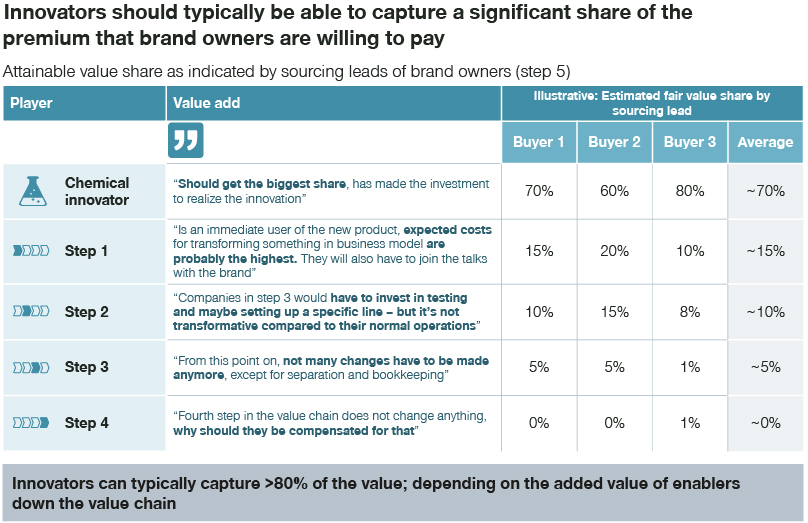

The traditional value chain model often results in premiums being charged at each link, ultimately leading to a prohibitively expensive end product for consumers. However, not every link in the chain contributes additional value to sustainable products. Revenue models should reflect this reality by distributing margins based on value addition.

Several revenue models, such as direct models or tolling models, offer opportunities for fair distribution of margins:

- Direct model: In a direct model, the producer of the sustainable innovation receives payment directly from the end-product beneficiary. For example, a producer of sustainable chemicals for cosmetics would sell their products as usual to the manufacturer but would be paid directly by the cosmetics brand. This model is particularly advantageous when the brand has limited control over margins in the value chain. However, brands adopting this model must exercise strong governance over product use throughout the value chain and ensure responsible material utilization in their products.

- Tolling model: In a tolling model, a later-stage participant in the value chain purchases goods directly from the innovator and then engages an intermediary party to further process, enhance, or modify the product. In this case, the innovator can sell directly to the tolling party, establishing a direct agreement between the innovator and the buyer.

It is crucial to engage in comprehensive discussions regarding these revenue models with stakeholders in the value chain, particularly those who stand to benefit the most. Understanding their perspectives on value addition and preferred revenue models is vital. By selecting a model that aligns with the needs of the value chain players and effectively spreads the willingness-to-pay from end customers across the fair value added along the chain, companies can create a sustainable and mutually beneficial business framework.

Success factor 5: Accelerate adoption through vertical integration or downstream partnerships

In addition to selecting the right price model, companies at the start of the value chain can explore vertical integration or partnerships to accelerate the transition. This ecosystem approach facilitates the establishment of claims and certifications, ensures product quality, and identifies synergies with other downstream innovations. Furthermore, it increases price steering to claim a greater share of the value add as an innovator.

Value chains are typically fixed, and it is easier to get a further reach down the chain to the players where the real value is added by engaging in strategic partnerships with already existing players rather than trying to set up new value chains or connections to these parties yourself. Identify possible acquisition or partnership strategies to speed up adoption of your innovation.

Conclusion

In the pursuit of successful sustainable innovations, it is crucial to consider the most value-added benefits, the beneficiaries, and their willingness-to-pay from the early stages, even during research and development. The success of these innovations relies on aligning the price model with industry expectations and ensuring a fair distribution of margins that accurately reflects the value added along the value chain. By implementing these key success factors, companies can drive positive change, create a compelling business case, and contribute to a sustainable future.