CMS recently published guidance on the Medicare Drug Price Negotiation Program (MDRP). But while this provides additional insight into the logistics, evidence requirements, and timeline for the impending price negotiations, several gaps remain. In this article, we highlight the key portions of the MDRP guidance, advise manufacturers on how to prepare for negotiations, and outline key dynamics for the first negotiation cycle.

The negotiation process

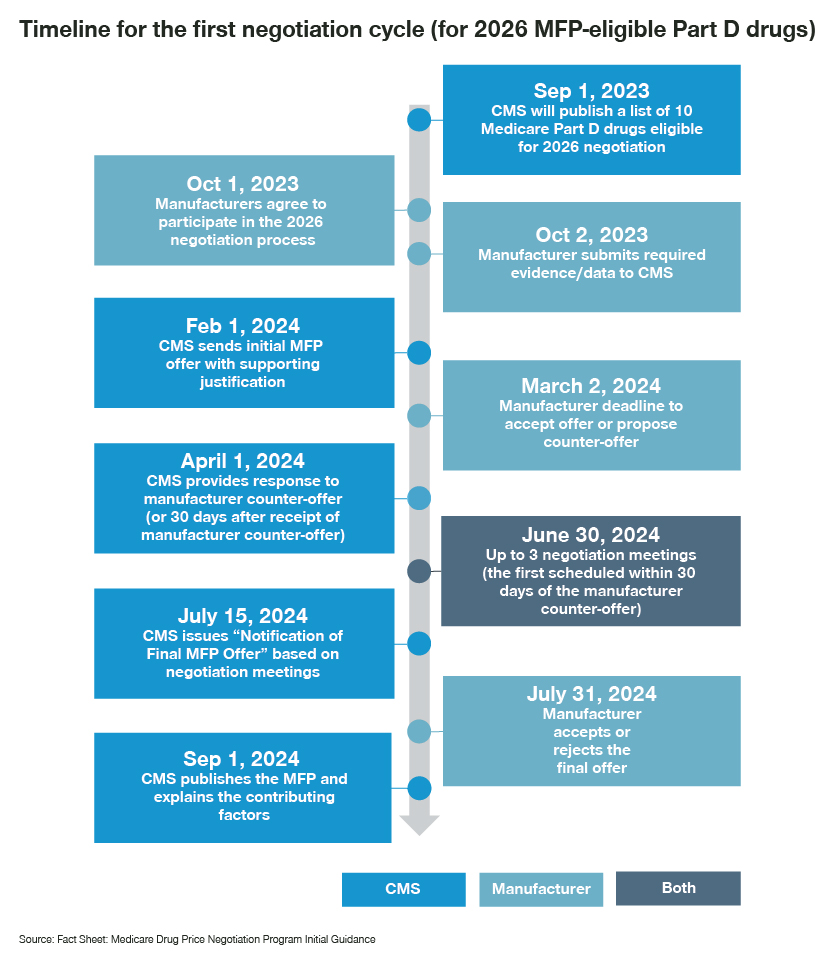

On September 1, CMS will announce the drugs eligible for the MDRP negotiation process – a key provision of the Inflation Reduction Act. The process leaves manufacturers with only one month to pull together all of the requested information. While manufacturers have not yet been notified whether their drugs will be eligible, it would be prudent to collate information and develop a strategy well in advance.

Once CMS has the information, they will develop a first offer and rationale for the “maximum fair price” and submit it to the manufacturer by February 1, 2024. Manufacturers then have 30 days to respond and may request up to three meetings with CMS to discuss the MFP. Negotiations must conclude by six months after the initial offer so that the final MFP can be published on September 1, 2024. Interestingly, the MFP will not actually become applicable until January 1, 2026.

Preparing for MDRP negotiations

Based on CMS’ initial guidance, we’ve identified key areas for manufacturers when preparing for the negotiations.

- Prepare the evidence package

Manufacturers will submit evidence regarding unmet need (i.e., disease/economic burden), positioning in treatment guidelines, utilization of potential therapeutic alternatives, clinical differentiation for the drug vs. therapeutic alternatives, specific information on the extent to which it addresses the unmet need among the Medicare patient population, and impactful peer-reviewed studies on the drug.

As a defining part of this opening scene, this evidence package offers an opportunity for manufacturers to influence what is considered the most appropriate therapeutic alternative and offer evidence or argumentation why other potential therapeutic alternatives are not appropriate.

- Engage external stakeholders

In addition to the manufacturer, clinical and patient advocacy groups may provide arguments in support of the value of a drug under negotiation. Statements from these stakeholders on the importance of the drug to the treatment paradigm, as well as its value vs. therapeutic alternatives, could be extremely helpful. While this might be difficult for the first batch of drugs selected for negotiation, for those eligible in subsequent cycles, it will be important to ensure that the drug is well represented in relevant treatment guidelines, society recommendations, and compendia.

Negotiation strategy for the MDRP process

- Outline the negotiation strategy

To be ready for the beginning of the negotiations, manufacturers should determine all the different scenarios the negotiation team could encounter. Understanding the likely therapeutic alternatives that the CMS could consider, the Part D net prices/ASP for these alternatives (including the FSS / Big Four prices), and perceived relative benefit will help gauge the range of preliminary prices the CMS could offer.

The CMS is expected to begin by identifying therapeutic alternatives from the same drug class (chemical class, therapeutic class, mechanism of action). Collating data on clinical differentiation vs. these alternatives will be key. In the case of multiple alternatives, the CMS will look across the range of net prices and determine the starting point based on utilization data. These considerations will help narrow the scope of scenarios that manufacturers could encounter. Developing negotiation and response strategies tailored to these likely scenarios will help manufacturers achieve the best possible outcome from the negotiation.

- Develop an internal consensus and training

While most manufacturers already have account teams well-versed and trained in coverage -related negotiations, the lack of precedence, magnitude of impact, short timeline, and “all-or-nothing” aspect of these negotiations presents several challenges. Internal alignment across clinical, commercial, marketing, legal, and leadership teams on the evidence used, strategies employed, and acceptable outcomes will be crucial. Adequately preparing negotiating teams via workshops, trainings, and mock negotiations, as well as developing materials for objection handling, will be essential.

Interesting dynamics of the first negotiation

While we do not yet know which drugs the CMS will initially shortlist, recent analyses have attempted to predict the eligible drug list for the first negotiation, with Eliquis, Xarelto, Januvia, Jardiance, Ibrance, Breo Ellipta, Symbicort, and Xtandi commonly featuring on these lists. Looking at these potential negotiation targets, there are some key questions/scenarios that manufacturers could face:

- Multiple drugs in the eligible list with indication overlap

Eliquis and Xarelto (both commonly used for the treatment of deep vein thrombosis and pulmonary embolism), Januvia and Jardiance (both anti-diabetic medications), and Breo Ellipta and Symbicort (both used in asthma and chronic obstructive pulmonary disease) may be eligible for the first round of negotiations.

Will the CMS assume the existing Part D net prices for these alternatives in negotiations for the other product? Or will they assume the eligible MFP discount? This would be particularly impactful due to the 60% non-FAMP discount for Januvia/Symbicort but only 25% non-FAMP discount for Jardiance/Breo Ellipta. How will the negotiations for one drug impact negotiations for the other? - Drugs with therapeutic alternatives that markedly differ in cost

How strong a benchmark will the CMS consider the commonly used lower-priced, generic fulvestrant that is used in the same line as Ibrance? For the anti-diabetic medications, how will the price of metformin impact the negotiations for Januvia and Jardiance? For Breo Ellipta and Symbicort, will the CMS stick to the same inhaler/combination LABA class, or will the higher priced biologics in asthma be part of the mix? - Differences based on pricing methodology itself

The consideration of drug cost for a course of treatment or per month (including those with induction and maintenance cycles), as well as consideration of median treatment duration or PFS, could impact the monthly/annual prices for oncology therapies used as benchmarks for Imbruvica and Xtandi. How will the CMS account for these differences when considering these price benchmarks? - Drugs with therapeutic alternatives with different dosing/combination use

Kisqali and Verzenio represent therapeutic alternatives for Ibrance in breast cancer. While CMS might begin at the Part D net prices for Kisqali/Verzenio, how will the CMS interpret the different dose adjustments/variations for Kisqali? Similarly, how will the CMS account for combinations used in chronic lymphocytic leukemia or breast cancer when considering the prices for Ibrance and Imbruvica, respectively?

How we can help

With the first ever MDRP negotiation process just around the corner, and several questions still to be addressed, the onus is on manufacturers to prepare for a wide range of possible scenarios to achieve a favorable negotiation outcome.

At Simon-Kucher, we have over 35 years of experience in guiding manufacturers with challenging negotiations, supported by extensive knowledge of negotiations in predominantly single-payer markets.

Reach out to Nathan Swilling today for support in navigating this complex process!