The Inflation Reduction Act could be the most significant development in the US pharma and biotech market since the creation of Medicare Part D. We’re here to help you understand the impact on your brands.

In our previous articles, we discussed the impact of the Inflation Reduction Act on US healthcare and how to prepare for the Medicare Drug Price negotiation process. In this article, we address several key questions which arise from the CMS’ initial guidance and try to bring some known to the unknowns.

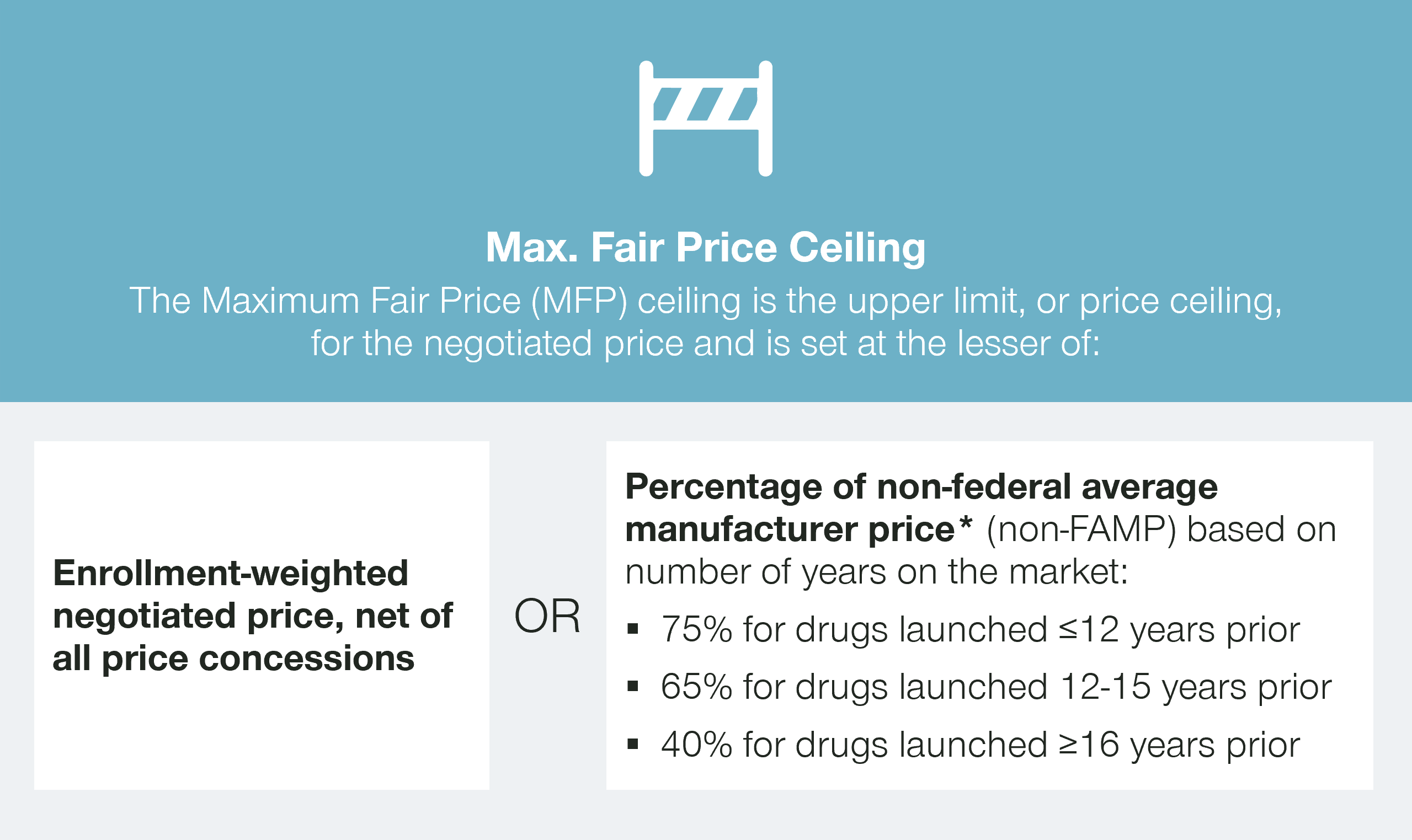

The Inflation Reduction Act sets a ceiling price for the maximum fair price (MFP) based on the length of time a therapy has been on the market. But what will be CMS’ actual target for negotiations?

The Inflation Reduction Act sets the initial starting point for negotiations as the lower of a certain percentage of the non-federal average manufacturer price (non-FAMP) or the net enrollment-weighted negotiated price, net of all price concessions.

While the rebates paid by manufacturers to Part D plans are confidential, they are required to report these rebates to CMS. This information will enable CMS to understand the net prices paid by Part D plans, both for the products under negotiation and the potential price comparators.

Interestingly, based on a 2017 report by the Congressional Budget Office (CBO), the net prices negotiated by Part D plans already are a significant discount from the wholesale acquisition cost (WAC), and the non-FAMP.

While these numbers are only an aggregate picture, they do suggest that the net prices paid by Part D may be a more significant benchmark than the non-FAMP. This of course depends on the length of time a drug has been on the market.

The Inflation Reduction Act is one of the signature accomplishments of the Biden administration. With an election season rapidly approaching, there will be significant interest in demonstrating that this program has resulted in savings to the government and seniors.

Interestingly, the net price paid by Medicaid is half that paid by Part D plans, largely due to the additional inflation-related penalties that are part of the Medicaid program. Will the prices paid by the Medicaid program also be considered as benchmarks for CMS? If so, the net result on revenues for manufacturers could be staggering.

What will be the “spill-over” effect, if any, from the MFP to the manufacturer’s non-Medicare business?

The impact of the Inflation Reduction Act for any manufacturer will heavily depend on the share of revenues realized from Part D enrollees versus other purchasers. However, there is also a key risk that the negotiated MFP has a spillover effect and impacts the prices realized by manufacturers in other channels.

Most of the payer stakeholders that administer Part D benefits are also involved in administering commercial pharmacy benefits as well, so they will have full knowledge of the MFP that has been set by CMS. Would knowledge of this MFP encourage these commercial stakeholders to seek greater rebates from manufacturers?

As seen above, we know that Part D drugs, on average, are granting discounts to payers of close to 40 percent. While we don’t know the average discount granted by manufacturers to commercial payers for these same therapies, we can assume that, in most cases, the discounts are not greater than the 23.1 percent statutory discount given to Medicaid. Doing so would trigger additional concessions to the Medicaid program.

Therefore, we can infer that the more generous rebates in the Part D program have not necessarily carried over to the commercial side of the business. The rebates that payers can extract from manufacturers are a function of the competitive marketplace and the level of control that payers are able to wield over their members’ utilization.

However, one wrinkle in this hypothesis is that a number of states are already working on legislation that will cap the prices paid by their residents at the MFP, regardless of how their therapies are covered. If these policies are successful, it would seem highly likely that other states will follow their lead and the CMS negotiated MFP would result in price erosion for all channels. If so, achieving the best possible outcome from the Inflation Reduction Act negotiation would have even greater importance.

How will Medicare Part D payers react to the significant cost exposure given that the Inflation Reduction Act has also limited the premium cost increases for patients?

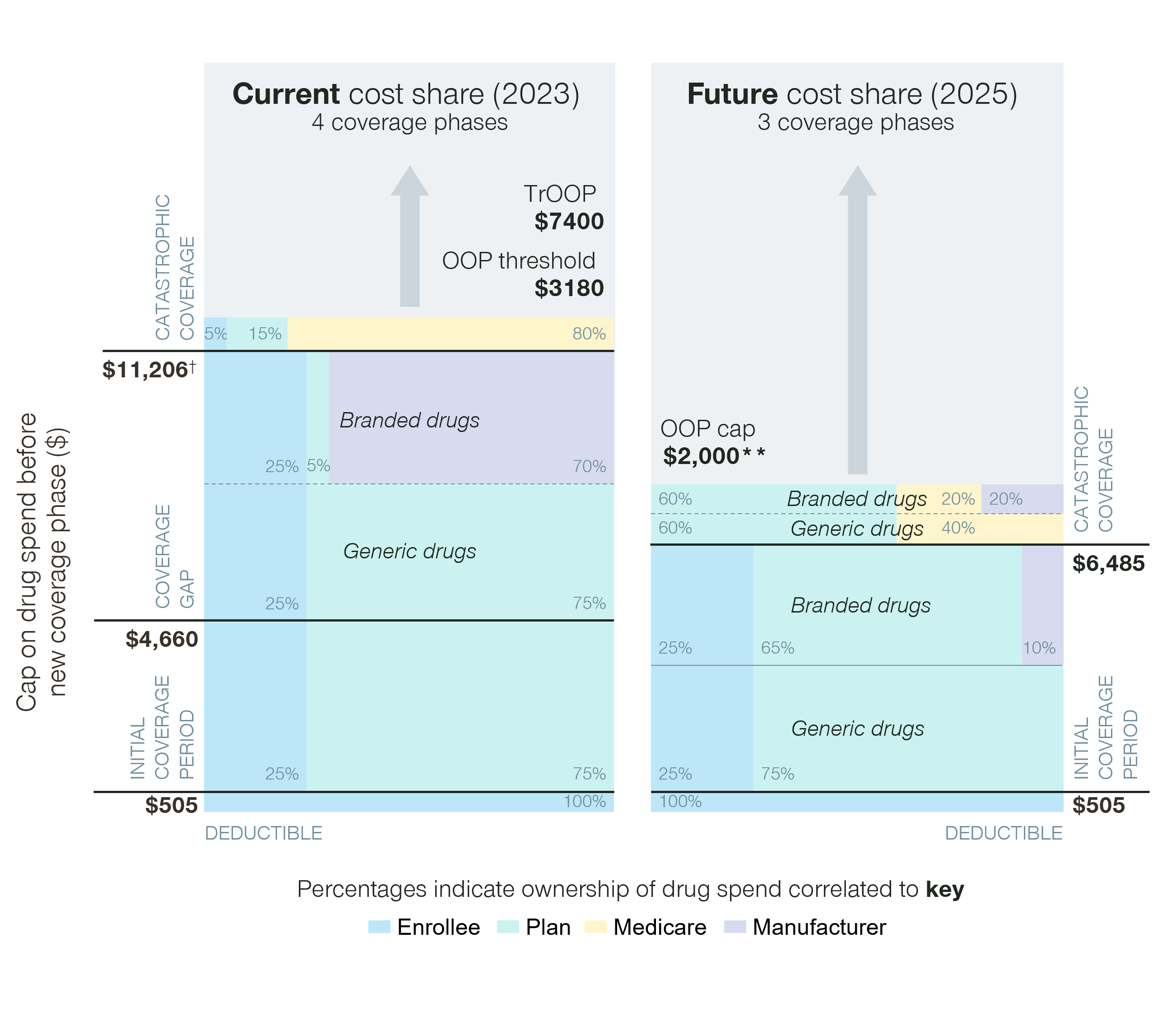

We know that the cost share for Medicare Part D plans in the catastrophic phase will increase from five percent and 15 percent, for branded and generic drugs respectively, to 60 percent for both branded and generic drugs.

Given that the catastrophic phase for some high-cost drugs can easily stretch into six figures, this is a significant new cost for Part D plans. In addition, the new OOP cap for Part D patients means that for many, the significant cost exposure of some of these agents has been reduced. We may therefore see increased utilization of these higher cost agents.

At the same time, the Inflation Reduction Act has limited future premium increases for patients to six percent annually. As a result, plans will likely feel financial pressure to reduce the number of patients on very high-cost drugs and/or find a way to obtain more favorable contracts from manufacturers.

Other than simply exiting the Part D market, there is only one main lever payers can pull to try and minimize their exposure to these higher cost therapies – utilization management. Unfortunately for payers, many of these higher-cost agents are part of the six protected classes initially developed as part of the Part D program. For these therapies, CMS has strongly discouraged the typical approaches of using step therapy, preferred tiers, or prior authorization to deter patients from initiating therapy with these agents. However, will we see payers become more creative in using softer approaches to utilization management with these agents as a way to save costs?

How will funding flow and distribution work for therapies dispensed or administered to MFP eligible patients?

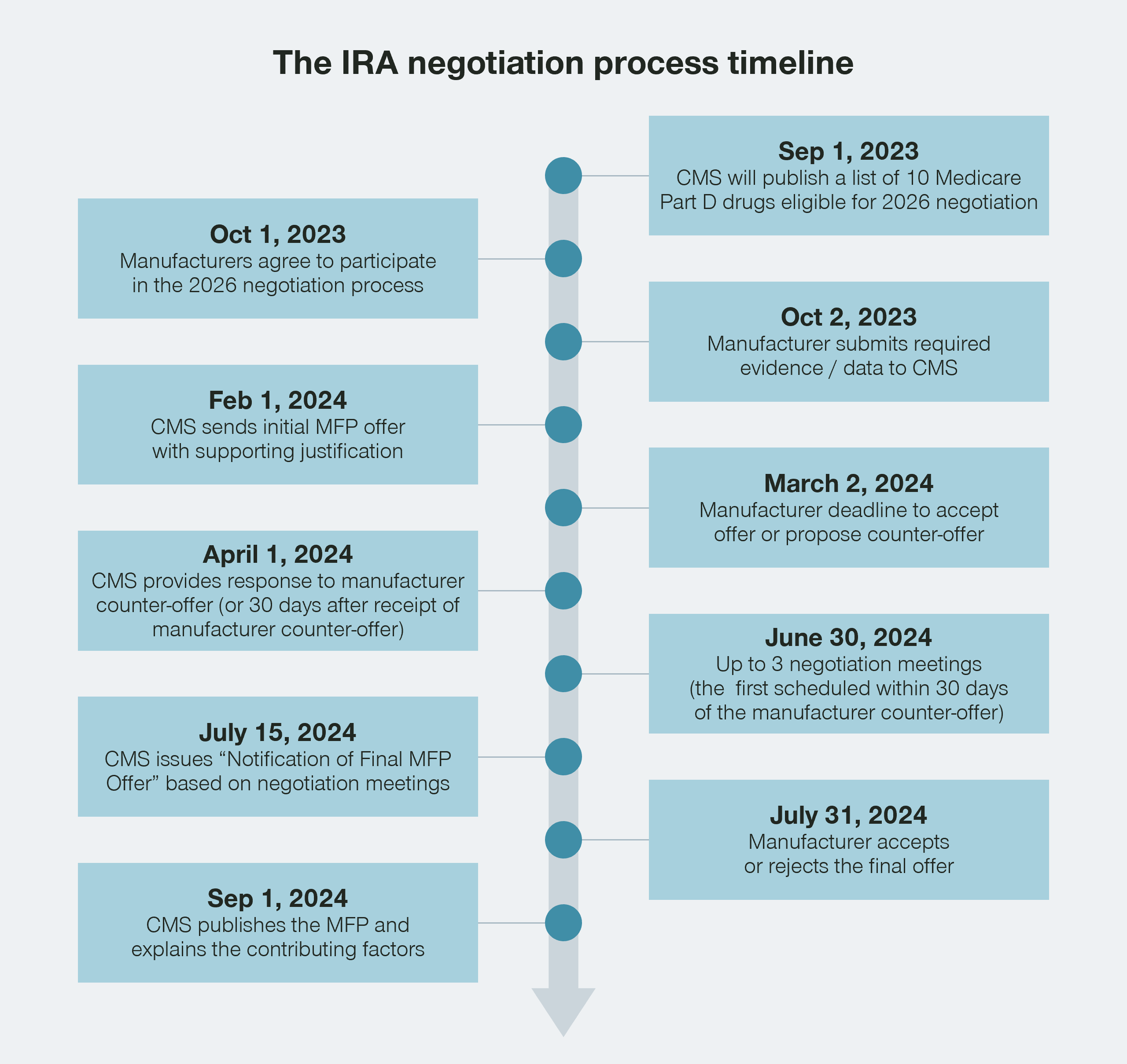

While we know that Maximum Fair Price (MFP) individuals will be able to purchase a drug at the MFP, it is currently unclear how the funding flow will work in practice. It is interesting to note that while the initial MFPs will be set early in 2024, the actual prices will not go into effect until January 1 of 2026. The timeline for the Inflation Reduction Act has given CMS, wholesalers, pharmacies, and other stakeholders a significant window of time to figure out how all of this will work in practice.

While Part B physician-administered drugs will not be part of the Inflation Reduction Act negotiation program for a few years, providers would typically be purchasing stock of therapies that will be administered both to MFP-eligible patients as well as non-MFP-eligible patients.

Assuming that manufacturers would differentiate the acquisition cost for MFP and non-MFP eligible patients, this creates an accounting challenge for manufacturers/wholesalers and providers. Providers would need to specify up front how many vials would be purchased to eventually be dispensed for MFP individuals, or potentially order vials on a named patient basis.

Alternatively, providers could keep track of how many vials of a therapy had been administered to MFP-eligible individuals and seek retroactive rebates from the manufacturer to lower the acquisition cost to the MFP. Either approach would seem to create some additional administrative hurdles for providers.

How we can help

The Inflation Reduction Act has the potential to be one of the most significant developments in the pharma and biotech market in the US since the creation of Medicare Part D.

Manufacturers receive billions of dollars in sales through the Medicare channel and correctly assessing the impact will be vital to the continued healthy success of the pharma and biotech market in the US.

Let’s work together to unpick these challenges. We can help you fully understand all implications for your brands undergoing negotiation, as well as the second order impact on your non-negotiated brands.

Reach out to Nathan Swilling today!