Is your P&MA function future ready? The increasing complexity of products, intensified competition, evolution of payers’ needs, and stricter healthcare systems are some of the factors that have increased the need to check in on your P&MA function!

As we have followed this multifaceted evolution over the last few years, pricing and market access (P&MA) has shifted from a technical function to a strategic one within global, regional, and local organizations.

Looking to the future, companies need to be prepared for the ongoing and upcoming changes to the requirements for the P&MA function.

According to best-in-class examples, a successful P&MA function needs to excel in three dimensions: establishing an effective set-up (organization), doing the right things (operations), and having the required capabilities in place (talent management).

Key areas for a best-in-class P&MA function

In our daily work with pharmaceutical companies, we have increasingly seen the P&MA function involved in the entire product lifecycle, focusing on operational and organizational aspects and collaboration between interdisciplinary teams.

This article seeks to provide an overview of the main challenges observed within the P&MA function along the three dimensions (i.e., organizations, operations, and talent management) and to look at best practices to ensure that the setup, activities, and capabilities of the P&MA function are prepared for the future.

For this purpose, we utilize Simon-Kucher’s Market Access Excellence (MAXX) scorecard survey. It shows major trends observed in the market and provides relevant benchmarks from world class organizations, highlighting required activities to build and grow a best-in-class P&MA function.

About Simon-Kucher’s MAXX scorecard Simon-Kucher’s Market Access Excellence (MAXX) scorecard gathers benchmarking insights based on feedback from over 70 global and regional P&MA professionals on how P&MA operates within their organizations. The results compare responses with best practices and benchmarks from the pharmaceutical industry based on Simon-Kuchers project experience to highlight areas for improvement so companies can ensure future success. |

Main challenges observed

Organization

- Low visibility of the P&MA function within company

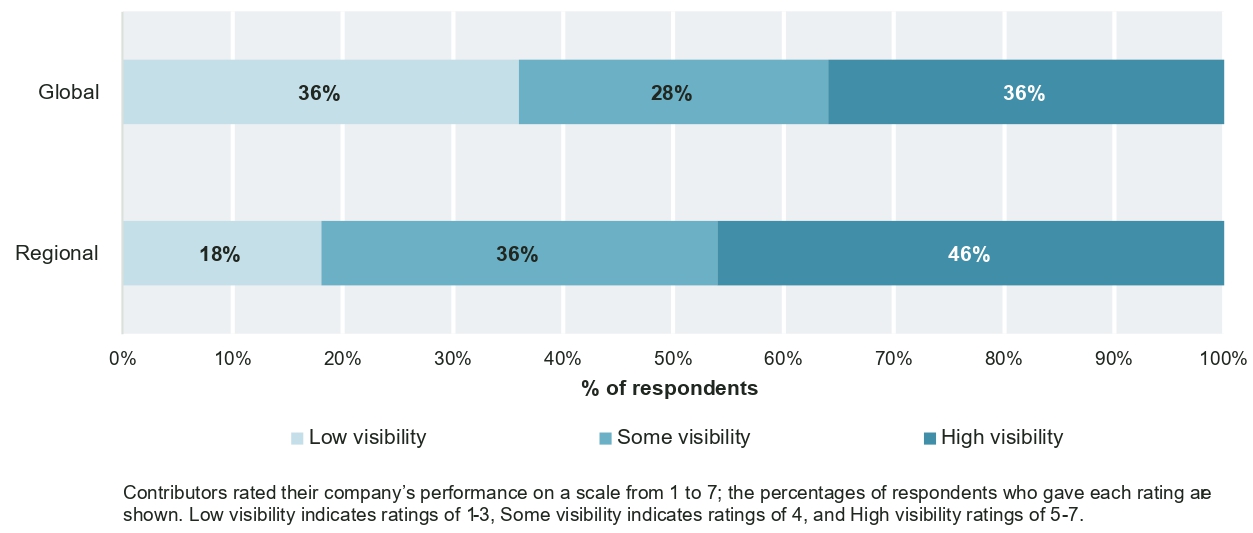

While the P&MA function has typically been a subfunction (e.g., of commercial/marketing) with limited visibility in the past, it is now increasingly visible to senior management. However, consistent senior management involvement in priority market access challenges still has room to grow as our survey shows.

Many P&MA professionals report that global P&MA activities are conducted in a dedicated department with a recognizable name and led by a head who is no more than two or three layers removed from the CEO but visibility is still lacking according to a substantial share of respondents.

However, most also report that senior management is rarely engaged in P&MA matters, with only 9% of respondents indicating any structured form of engagement (e.g., through an official pricing and access committee).

P&MA function visibility

- Misalignment between P&MA sizing: resources and workload

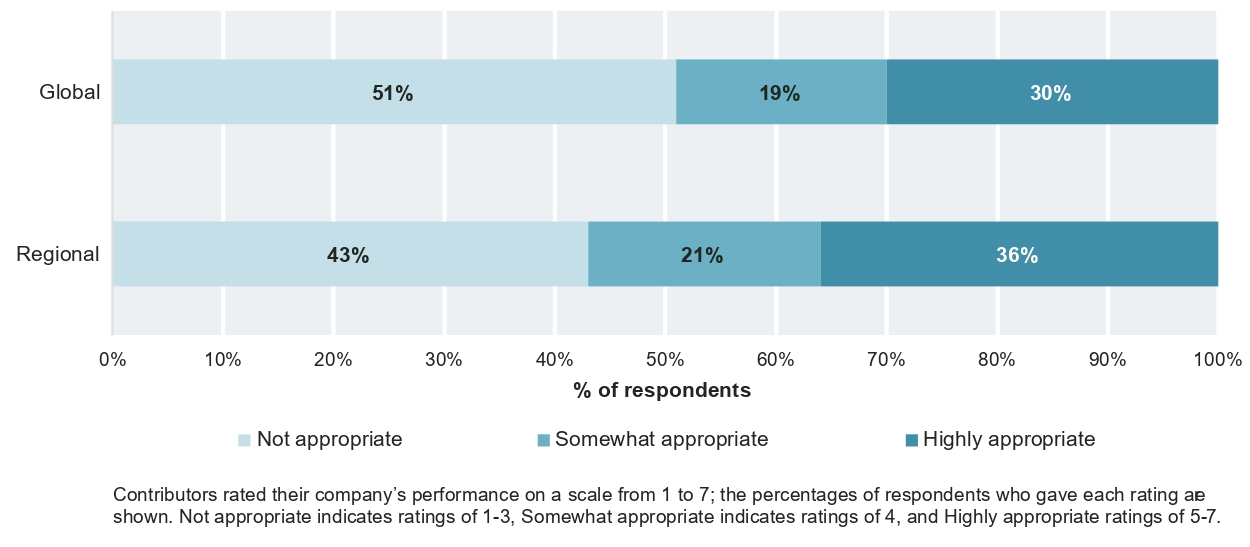

Because the visibility and importance of the P&MA function is increasing, it is essential that the team has sufficient staffing resources to complete the tasks assigned to it.

However, according to the report’s findings, P&MA professionals think that the resource situation is not aligned with the function’s needs and the expectations towards their team, with only approximately 1/3 of all respondents saying that staffing is consciously kept in line with the function’s workload. This can become a serious issue since key P&MA deliverables may not be available on time or with the required quality, jeopardizing the commercial success of an asset. When resources are tight it is crucial to have a prioritization of key P&MA deliverables in place to ensure business-critical needs are met.

Staffing alignment with workload

- Cross-functional collaboration

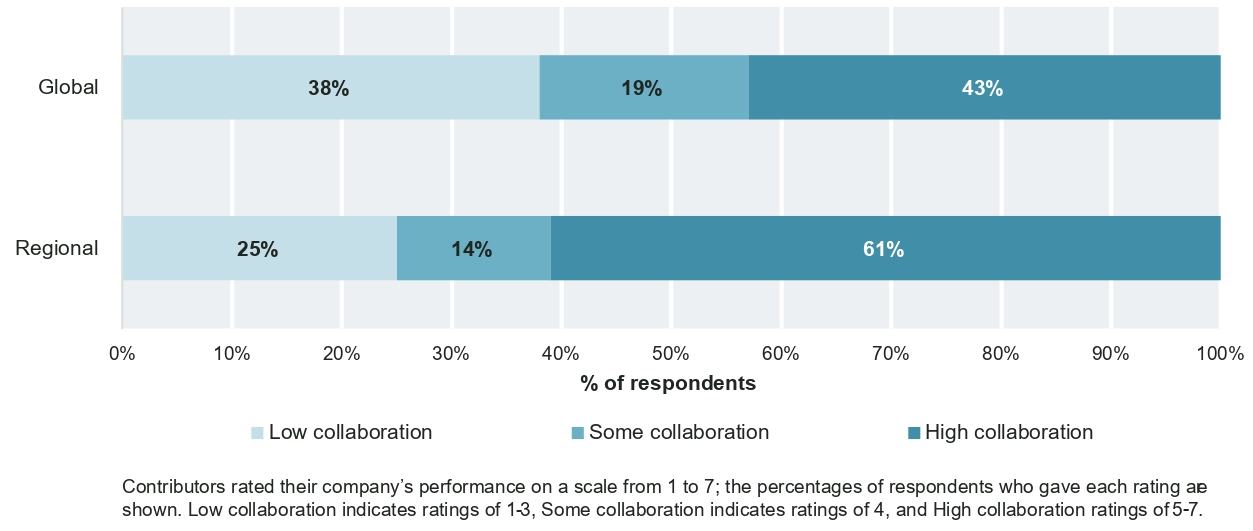

P&MA teams interact with multiple internal stakeholders to gather information they need to successfully launch and market new and existing products.

Among best-in-class organizations, global P&MA is a member of the key cross-functional teams, with functions following set procedures to coordinate with P&MA. 43% of global and 61% of regional contributors report that the P&MA function is one of the key cross-functional teams in their company. For those companies in which P&MA is not sufficiently represented at cross-functional discussions (>50% according to this survey), there is a risk of misalignment and silo mentality.

Cross-functional collaboration

Operations

Unclear roles and responsibilities

While the prominence of P&MA across functions within organizations is clearly rising, responsibilities within the P&MA function itself are often less clear. Only 34% of global P&MA professionals feel that roles and responsibilities, including the final decision maker(s), are clearly assigned within P&MA teams. Additionally, the goals of the P&MA function are not always entirely clear, with 60% of global P&MA professionals reporting that KPIs are not precisely defined or appreciated by senior management and are therefore not followed as standard procedure.

Late engagement in P&MA activities

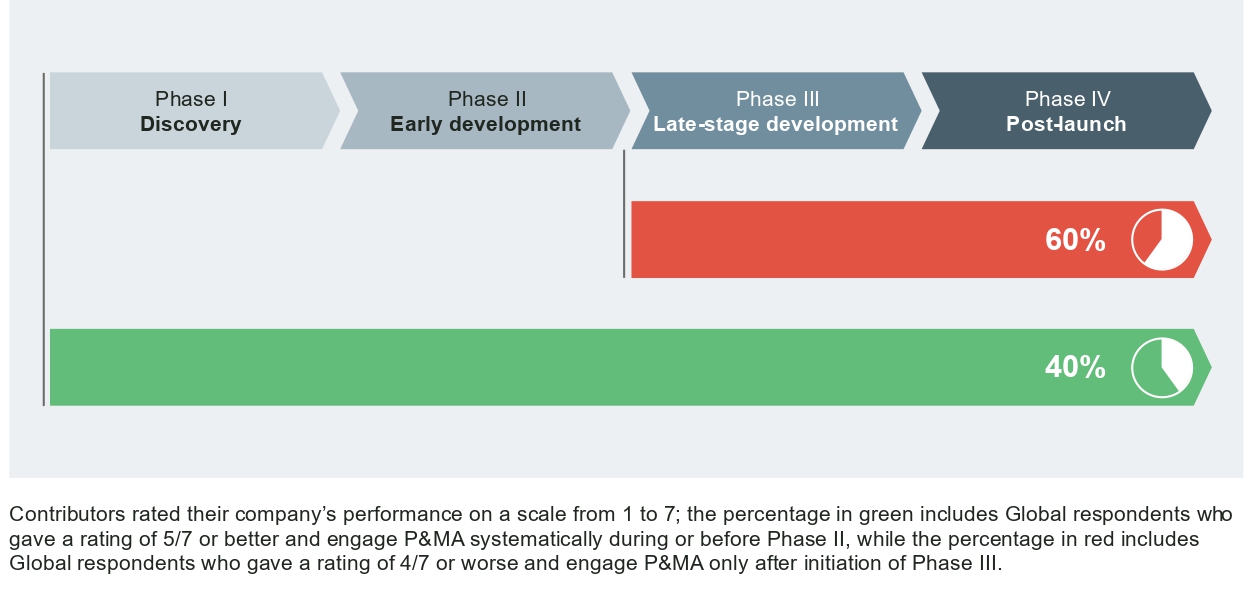

The involvement of the P&MA function in pipeline decisions and throughout the product life cycle is essential to successfully defining the pricing and market access plan. Best-in-class organizations start aligning with commercial teams in key markets before the initiation of Phase II trials, with P&MA activities following a clearly defined plan.

Earlier involvement of P&MA is a lagging indicator. Only 40% of global contributors report beginning alignment with commercial teams in key markets at Phase II or earlier, many of which do so without a clearly defined plan to roll out P&MA activities. Most companies still erroneously engage P&MA teams only during Phase III or later.

Timing of P&MA team involvement

Talent management

- Lack of P&MA training

P&MA functions have assumed a variety of demands and inputs from across functions within each company, from the early stages of product development to launch and thereafter.

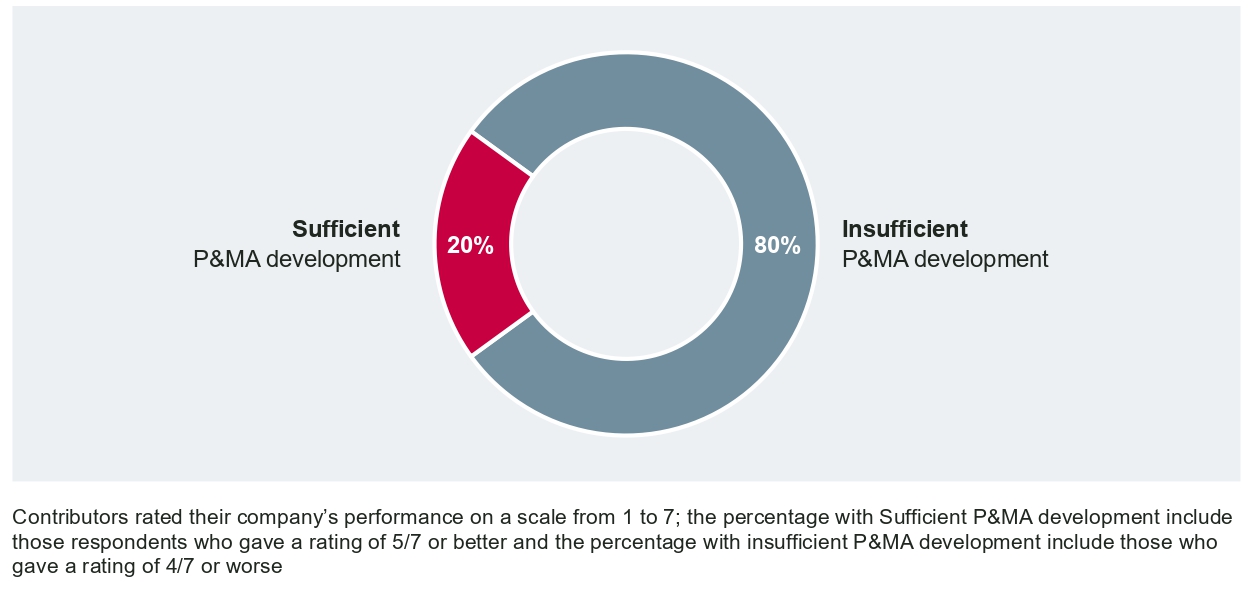

However, training programs for P&MA personnel are underdeveloped in most companies, with only around 20% of professionals reporting that their company has a market access curriculum, despite employees’ lack of expertise in certain areas and disorganized training programs even among the more developed cases.

Availability of P&MA development programs (all respondents)

Best practices and solutions

Our study has shown that some companies are on the right path to making their P&MA function future-proof. Companies are clearly investing more in P&MA at earlier stages, but this investment has still not reached the level required to solve the business challenges that are being faced. Many companies still must make progress in their efforts to develop a best-in-class P&MA function.

Solutions should address the same key areas where challenges were identified above:

Organization

- Clearly define the vision and mission of the P&MA function, as this clarifies the function’s purpose and mitigates any potential uncertainty concerning its overall concept

- Nominate a single senior management representative with close access to the C-level being responsible for the P&MA function to ensure internal visibility and sufficient resources for the function

- Define the P&MA function’s role in key committees to establish cross-functional touchpoints and ensure P&MA input is considered appropriately

- Clarify the strategic importance of the P&MA function to senior management: Market access is about more than just selecting a price point; it includes all the activities behind the successful launch of new products.

- Ensure the P&MA function has right size in relation to the workload (e.g., according to pipeline extension, products’ lifecycle, etc.)

Examples for pricing and market access focus areas

Operations

- Develop clear descriptions of roles and responsibilities for each member of the P&MA function

- Reflect the strategic elements of the P&MA function to avoid a limitation to a solely technical and operational role

- Ensure responsibilities are clearly defined, escalation routes are established, responsibility for different decisions is assigned to specific individuals, and these decisions are consistently implemented based on protocols

- Outline a framework for P&MA activities from pre-clinical development to post-LoE to ensure P&MA input is provided at all stages of the product lifecycle and payer needs and preferences are continuously considered

- Introduce KPIs and a monitoring system to ensure that the P&MA function is operating as expected

Talent management

- Define the technical and strategic skills that are required for employees to have success within P&MA roles

- Include these specific skills in job descriptions and test for them when making hiring decisions

- Invest in a P&MA curriculum and implement relevant training programs that teaches relevant skills to properly prepare your P&MA professionals and ensure their success.

- Clearly communicate progression through attractive career pathways, including options to transition from other functions to P&MA and vice versa

With contributions by co-author Cameron Pott.