Introduction

In times of uncertainty and market volatility, as income is adversely impacted by reduced transaction volumes and falling asset values, private banks and wealth managers should set a key commercial priority to review their existing price enforcement and discounting approach.

Until the market downturn in 2022, private banks and wealth managers had enjoyed favorable market conditions for more than a decade, with growing asset values and healthy investing activity. As such, price enforcement was not a main concern for banks when acquiring new clients, resulting in a more relaxed pricing discipline and, in turn, to relatively large and unstructured discounts. This lack of a structured, differentiated target price and discounting logic results in excessive, ongoing revenue leakage, which builds up over time within the client book.

Only now, as margins have come under more pressure, banks are starting to truly feel the consequences of their history of relaxed and unstructured pricing and discounting. Reviewing the discounts of underpriced clients can be one of the most impactful initiatives to unlock margin and revenue growth for the sector during times of uncertainty.

The current industry norm

Our experience shows that discounting guidelines of private banks are characterized by a lack of structure and guidelines that are rarely aligned with the banks’ overall strategic objectives. Decisions around discounts are often inconsistent and linked to individual products or even individual fee types and therefore lack the necessary transparency. Instead, discounts should be based on considerations of the full client relationships and/or profitability.

What we also commonly see is that special conditions that are currently in place were often granted on premises that aren’t valid anymore, on requirements that were never fulfilled, or simply not in accordance with set discounting principles. The result is the main problem in this field: a large proportion of underpriced clients and significant revenue leakage.

The challenges of rectifying underpriced client relationships

Define meaningful profitability targets

Defining profitability targets at the product/portfolio level can be useful, but the view is too narrow. It is necessary to have a broader “client relationship view” since more discounts should be granted to larger clients.

Still, it’s not wise to define targets exclusively based on the relationship’s assets under management (AuM), as other factors such as product mix and transaction turnover also play an important role. Due to such factors, it is difficult to establish whether a relationship is well priced or not. Moreover, due to the product mix, there might be few – if –any – similar relationships in a bank client basis that are useful for comparison.

Therefore, given that a holistic client relationship view is key, the challenge is finding the right way to segment client relationships and define meaningful profitability targets, with the final objective of identifying underpriced client relationships.

Effectively repricing clients

Defining meaningful targets and identifying underpriced clients is only part of the job. Once such clients are identified, appropriate pricing measures need to be defined and implemented.

For this task, relationship managers must have enough transparency to effectively review their clients’ discounts. This ideally requires some sort of dashboard and discount simulation tool so that the economic impact of granted discounts is appropriately evaluated.

Furthermore, the initiative requires attention from many stakeholders to succeed: senior management, legal and compliance, relationship managers, operations, and IT. Therefore, proper coordination and reporting is key.

Our solution: Pricing heatmap

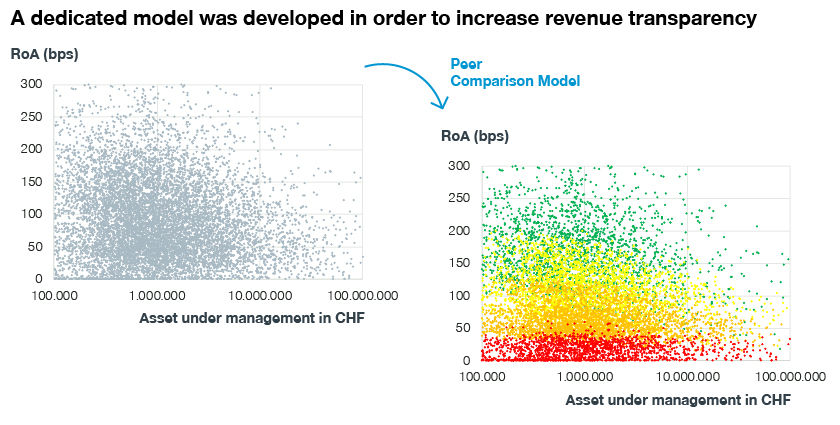

To help private banks and wealth managers facing these challenges, we have developed an approach based on peer pricing. The approach enables managers to effectively assess relationships’ profitability (simple color coding: red, amber, yellow, and green) and define profitability targets at a client-relationship level.

We analyze how different factors affect the profitability of client relationships in terms of return on assets (RoA), for example, how a relationship with a high share of added value services (i.e., advisory and discretionary) is more likely to have a higher RoA than one with a lower share.

This allows us to define a profitability target for each relationship that accounts for all the factors that can influence RoA.

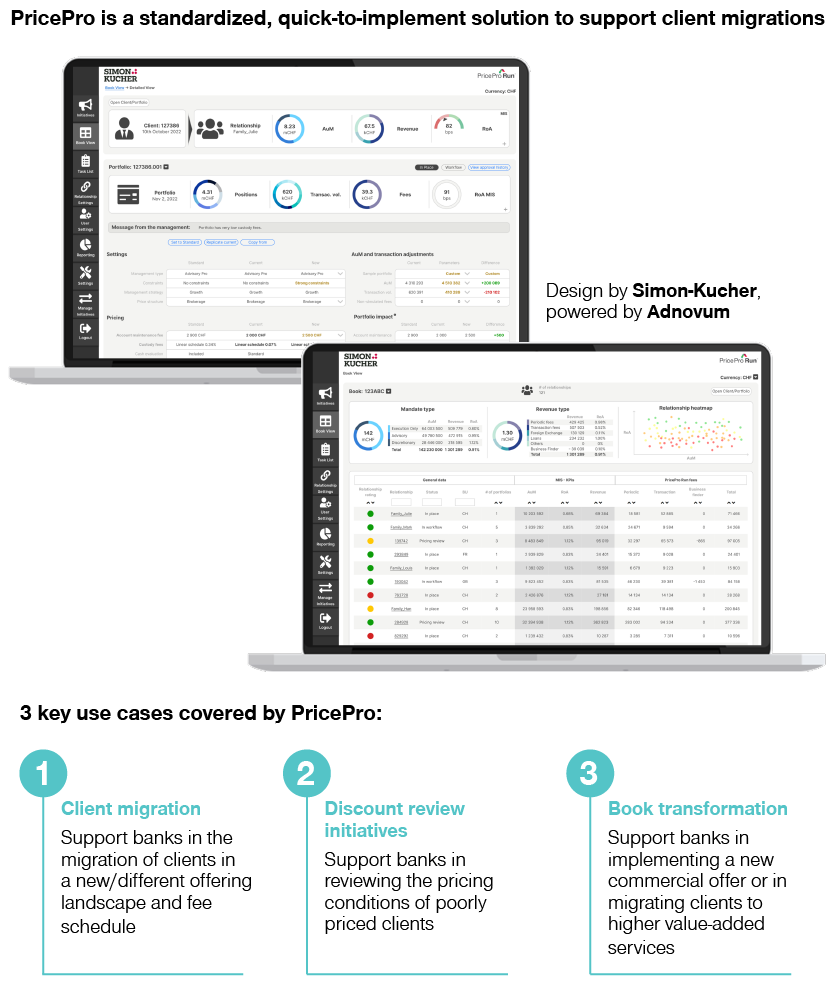

These targets are then used to perform a well-structured discount review by means of our initiative management tool. Relevant client data (revenue, positions, transactions, etc.) and the defined profitability targets are entered into the tool. Relationship managers are then able to effectively review their clients’ discounts, set and simulate new pricing scenarios, and achieve transparency on how different discounts will affect a client’s KPIs – and ultimately, the bank’s revenues.

Once the relationship managers have reviewed their client base, the tool outputs a file with the clients’ new pricing conditions to be implemented in the core banking system.

Our long-term solution

Discount review initiatives are effective tactical solutions. Following the initiative, banks are likely to observe a sudden and significant revenue increase. However, to keep margins under control, a proper discount management approach should be defined.

Simon-Kucher has developed PricePro Run, a comprehensive revenue and discount management solution that integrates multiple Simon-Kucher pricing methodologies for banking.

Read more in this article:

Discount Management in Private Banking: How to Overcome the Top Three Challenges