How to build strategies and create value for money for transfer operators during times of change.

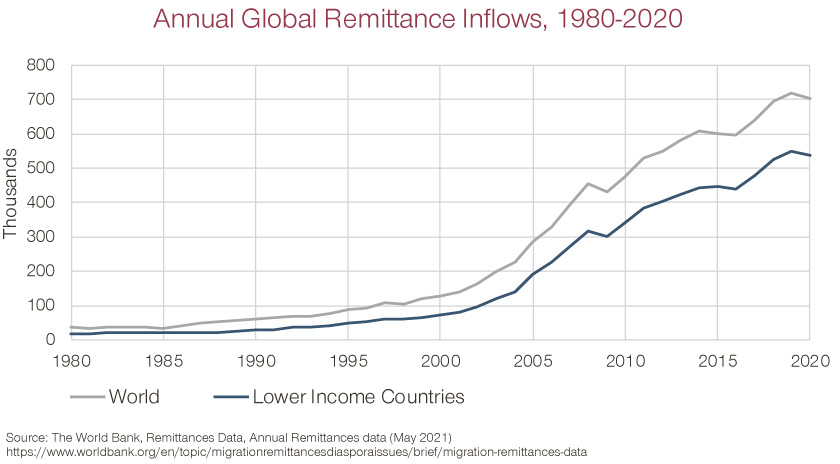

Remittance flows have been growing reliably without fail for years. According to figures released by the World Bank, remittance flows to lower- and middle-income countries (LMIC) reached a record high of $548 billion in 2019. These flows declined slightly to $540 billion in 2020 in wake of the COVID-19 pandemic, albeit not as drastically as initially forecasted.

It is no surprise that there was a drop in remittances due to the pandemic. The first round of lockdowns led to an abrupt stop of income or at least income uncertainty for workers around the world as employees were laid off or furloughed. This naturally meant workers were out of funds or with limited funds to send.

Signs of resilience for remittance flows

However, the fact is, remittance flows only declined by 1.6 percent between 2019 in 2020. Why is that? Some of this resilience can be explained by factors such as more supportive government stimulus programs offered in host countries, and favorable movements in currency exchange rates. However, evolution of the market landscape in the last decade has also played a strong role.

Online channels for sending money have been gaining traction with the emergence of lower-cost online only players and in response online channels pushed by the traditional players. In parallel, swathes of the developing world have seen a rise in digital banking in the form of mobile money accounts and bank accounts. So when the “stay at home” orders led to cash-based transfers plummeting, online channels provided a swift solution. Senders increasingly switched to online channels or increased their share of transactions sent through online channels. In Q1 2020, for instance, both Western Union and MoneyGram reported double-digit growth in their online business.

It also helps online channels that the cost of sending money is typically lower – an important factor for senders in these challenging economic times. The World Bank cites that the price of sending $200 averages at 11 percent when sending via banks; nine percent by post office; six percent by online services; and three percent by mobile providers.

On the flip side, for the transfer companies, it has meant more price pressure. Not only do customers have more companies to choose from, but they can also easily use any of these providers for every single transaction.

Looking ahead, as the COVID-19-related restrictions are eased, a large share of the senders who started using online channels during the pandemic are expected to continue using them. This suggests a balancing act for Money Transfer Operators (MTOs): it is crucial to protect existing revenue, while also adapting business models and fending off the competition, to accommodate the change to lower priced channels.

Catering to customer needs

Given these developments within the remittance landscape, companies might consider how they can adapt and cater to their customers’ money-sending needs. Here there are several practical steps that remittance companies can take. Firstly, by articulating their pricing strategy, and secondly, by defining a plan for customer retention for both the short and long term.

Setting the pricing strategy

- Evaluate the model: If customer transaction patterns have changed, assessing patterns in customer sensitivity would help to identify better ways to charge. If customers are sending smaller amounts but more frequently or if they are grouping together their transactions and sending larger amounts, a re-think of the distribution of total fees between transfer fee and FX mark-up may benefit both remittance companies and senders. For instance, a lower fee may be charged for the lower transaction amounts while a higher fee charged for the larger transaction amounts.

- Differentiate: Given the rise of multiple pay-in and pay-out methods, and

changes seen in remittance flows, analyzing where key changes are occurring and differentiating accordingly would also help target these changes effectively. For example, money-sending between the UAE to the Philippines (Lower-Middle Income Country/Lower-Middle Income Country, likely staple remitting) is very different from the US to UK (High Income Country/High Income Country, more discretionary remitting). Segmenting a service offering by geography or recipient country, by staple vs. discretionary remittances, and by pay-in/pay-out methods are options for remittance companies to consider.

Generating customer value through lifecycle

- Acquire: First, promotions are a proven way for remittance companies to acquire new customers – particularly in the digital world. Offering first-send-free, or better exchange rates are options that could encourage use of your platform. Referral programs offered by the likes of Wise (previously TransferWise) which enable senders to earn money for inviting friends via email (e.g. “Earn 75 GBP for 3 friends”) are effective ways to build a loyal customer base while generating the all-important word of mouth publicity in the remittance industry. For a remittance company, when designing the acquisition promotion, it is important to consider what kind of customers to attract and consequently the factors important to these customers to ensure that the acquisition investment is well spent.

- Retain: For a mid-term solution, operators can think of enhancing their commercial model. The atypical model in the industry has been a pay-as-you-go one where customers pay for each transfer. Instead, remittance companies can think about innovating the model to drive repeat business and customer “stickiness”. Examples might include offering a subscription solution to send funds at a more favorable FX rates or to make transfer-fee-free transfers. It might be something as simple but effective as pre-pay for a certain number of transactions to get a discount. As with acquisition offers, it is again important to understand customer behaviors and preferences to ensure well-calibrated and effective offers.

- Engage: Finally, in the long term, building out and offering a loyalty program can help engage customers to boost both acquisition and retention. Think of credit card points or miles: such programs reward payment for spend on a particular card, which then becomes habit. Similarly, you could imagine a world where customers get “points” with each remittance payment dollar, to build up and earn free transfers or other rewards. A win-win for transfer companies and for customers. Here again, setting up the “earn and burn” factors and rate are both equally important for a successful scheme.

Despite the dip in remittance flows since the COVID-19 pandemic, there are clear signs of resilience in this market. In fact, the lower-than-expected slowdown in flows indicates an opportunity for remittance companies: by adapting their pricing strategies and preparing to better retain and sustain customer value, MTOs can better serve their customers in the new landscape.