Moving from transactional pricing to innovative revenue models has been a focal point of diagnostic companies in the last decade. And the advantages are clear: Innovative revenue models offer economic benefits and certainty for customers, while suppliers profit from long-term contractual engagements as well as upselling opportunities. However, this win-win situation only comes to life if Dx companies transform their strategy and operations successfully, which was not the case in recent years.

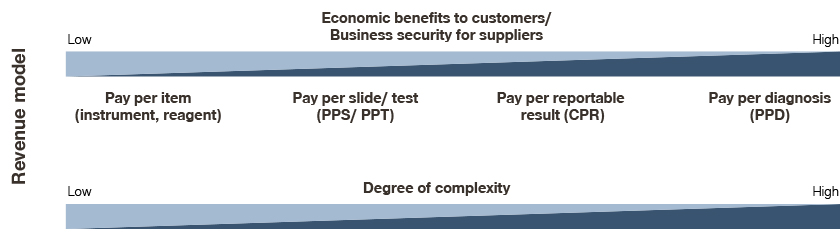

Two ends of the spectrum: From pay per item to pay per diagnosis

The benefits of innovative business models are significant: Although the offering is becoming more complex when moving from pay per item to pay per diagnosis, it provides unique opportunities for customers and suppliers. This becomes obvious when looking at a range of revenues models with differing degrees of innovativeness:

- Pay per item: Customers pay separately for individual products and services. That way, depending on customers’ demands, especially CAPEX may add up significantly. Suppliers on the other hand are selling only individual products which enables customers to ”cherry pick” from various suppliers.

- Pay per slide/ test: Customers pay per slide or test which includes all complementary consumables as well as the costs for the capital equipment. In many cases, the capital equipment remains in the ownership of the supplier; service is mandatory and might be added to the total value of ownership. In return, suppliers are able to differentiate themselves from the competition and thus increase customer loyalty.

- Pay per reportable result/image: This business model enables customers to pay per reportable test/image regardless of the consumables and capital equipment used to derive the result. Once again, customers receive a much more complex and valuable product. Suppliers are becoming a more valuable partner to engage in optimizing customer workflow, consumption and operations.

- Pay per diagnosis: This is the one-stop-shop of Dx offering models. Customers pay a fixed fee per diagnosis regardless of number or type of tests/images conducted and consumables, capital equipment, and services used. At the same time, by “outsourcing” the whole process, they can guarantee a higher quality as well as increase their efficiency. Suppliers have full control over every instance when their product is involved, which enables them to offer better quality as well as ensure long-term customer loyalty and recurring revenues. At the same time this model is highly complex for suppliers from an operational perspective.

Economic benefits to customers & business security for suppliers

How do the economic benefits for customers look like in more detail? There are four areas from which customers profit:

- CAPEX to OPEX: Customers avoid upfront investment.

- Link between operations and reimbursement: They secure operating profitability.

- Price and budget certainty: Many models allow for better financial planning.

- Innovation adoption: Customers ensure technology upgrades.

The first three points are of key importance due to an ongoing professionalization and shift of purchasing decisions to buying centers; e.g. integrated delivery networks in the US demand innovative revenue models to accelerate value-based healthcare.

At the same time, those innovative revenue models offer benefits to suppliers:

- Superior value to customers: Suppliers can differentiate from competition, better addressing a financially-driven and risk-averse customer segment.

- Lock in of customers: Dx companies can engage more closely with their customers, embark on longer and broader contractual agreements, and also escape pure product-by-product comparisons to some extent.

- Capture larger piece of the pie: They can offer full-stop-shop, bundling hardware, software, service, and consumables.

- Drive innovation: Dx suppliers can better position themselves to be on the forefront of value-based healthcare with new revenue models.

Digitalization and personalized medicine as key enablers

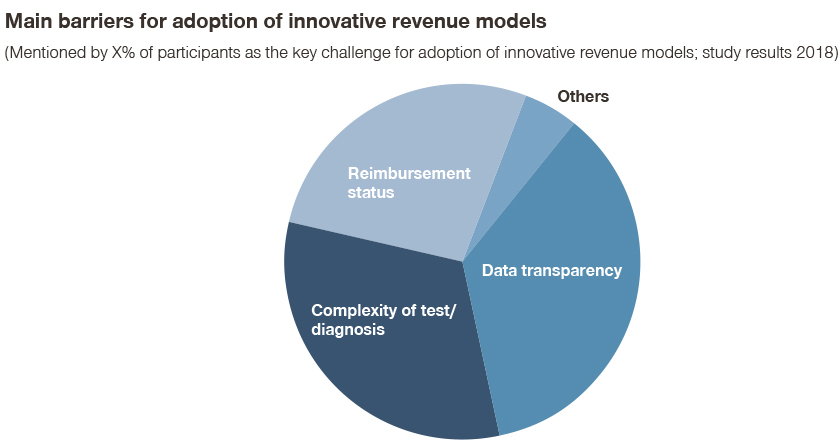

Given the benefits to customer and supplier, moving away from transactional pricing to innovative revenue models has always been the ambition of Diagnostic companies in the last decade. However, adoption of revenue models has been slow in the past. In a study conducted in 2018, 36 percent of respondents still mentioned data transparency requirements as the key adoption barrier. And 27 percent of respondents mentioned the only slowly changing reimbursement model as the key challenge.

In recent years adoption barriers have decreased due to the use of (information) technology and changing reimbursement models:

- Digitalization and decision support: Digital test processing, interpretation, and visualization to enable faster and better clinical decision support

- Personalized medicine: Personalized medicine enabled through use of new technologies, such as NGS and companion diagnostics

- Merger of Dx sub-technologies: Merger of diagnostic tests/use of multiple diagnostic tests, such as IHC and NGS, to support individual treatment pathway

- Merger of Dx and pharma: Merger of Dx and pharma to bundle capabilities and work collaboratively on diagnostic-treatment-combinations

All of these combined offerings have the goal to capture more value for customers as well as patients, while at the same time open up more revenue sources for Dx suppliers. A top industry experts’ opinions: “I think five years from now most of the contracts will be price per patient diagnosis due to the combination of IHC and NGS. This isn't in the market yet, but it's not far away, since all big players are pursuing this either in-house or through partnerships.” Also: “Price per patient will be the future price model once diagnostics and pharma truly converge with the expected rise in targeted therapies. Otherwise it would not be feasible to price this bundle.”

Strategy & operations need to be mastered to make innovative revenue models a success

To ensure that the benefits mentioned above come into full action, there are a variety of measures necessary. Both, strategy and operations need to be considered to make innovative revenue models a success. From the strategic perspective, Dx companies have to ask themselves what the opportunities and associated business risk are, considering environmental trends and market, competitor, and customer dynamics. The answers enable them to define a suitable strategy for their new revenue model. From an operational perspective, they have to make sure to secure implementation and operational efficiency, especially giving the increased risk factor, data transparency needs, automation requirements, system/tool support, and compliance/regulatory needs. If that fails, even the most perfect strategy won’t achieve the desired results. But how should companies get going? In order to find key strategic and operational pillars that make innovative revenue models a success, we looked at industry examples and distilled for each of the two action areas a best as well as a worst practice example. What were success factors? What lead them to failure? Find out in our two papers, including a practical checklist: