Ever wondered why prices end in 90 or 99? You can find “99” price tags everywhere, from your bar of chocolate at the supermarket to your monthly gym subscription. So why do products have prices ending in 99 rather than rounded up to the next figure? This is part 3 of our Pricing Basics series.

Due to what is known as the left-digit effect, customers tend to round to the next lowest monetary unit. We see the left digit first, and so instinctively form an opinion on price before our rationale can catch up. A lower first number at the start of a price (e.g. $3.99 vs. $4.00) has a huge psychological impact, even though the price is more or less the same. Endings in 99 increase sales of low value items, with the customer focusing on the lower digit on the left.

Prices are a key product feature. They are immediately evident and extremely relevant when customers make their purchase decision. However, the 99 example tells us a lot more than just why there is a pile of one cent coins lying at the bottom of every wallet. More importantly, this pricing tactic highlights how customers are not always rational when thinking about price. And this is where psychological pricing comes into play.

The left-digit effect is one of the oldest and simplest examples to explain customer behavior. However, the potential of psychological pricing extends much further beyond price tags set at 99. Companies can harness many advantages of psychological pricing to make prices more attractive to customers – which mechanisms to use often depend on your product and business. Here are our top five:

1. The compromise effect

Imagine you are in the supermarket, looking for a bottle of wine. You have the choice between three bottles, and you are not familiar with the brands or quality. Which wine do you buy?

Did you choose the middle bottle for $10? Few people will stand in a supermarket aisle calculating the optimal price for one product. Customers tend toward the middle, especially with decisions that seem insignificant. They assume they can’t go wrong with the standard, middle option. Choice architecture can play a fundamental role in the pricing of a wide range of products and services. Providing an adequate number of available options can nudge the customer to a more valuable product choice, and by that we mean also valuable for you, the seller.

2. The anchoring effect

For some products, customers have certain price points in mind. For others, they need an anchor. The trick is to create a reference price that is higher than the final price. In an experiment, a group of customers were asked if they would be willing to pay $189.99 for a new radio, and the majority considered the product to be overpriced. The next group were presented with a slightly different scenario: they had the opportunity to buy a $500 radio with around 62% reduction ¬– a radio for $189.99. Both groups were actually offered the same radio for the same price, but the group offered the discount were much more willing to buy the product. This can be explained by transaction utility theory, where the price itself is what signals and generates value in the eyes of the customer.

3. The endowment effect

The willingness to pay for services or products that customers already own (in a perceived or factual way) is higher than for services or products that they have to actively acquire. In another experiment, one group of customers were asked to add toppings to a $5 base cheese pizza at a cost of $0.50 each. Meanwhile, another group were given a pizza with all 12 ingredients for $11.00 and could remove toppings for a reduction of -$0.50 for each ingredient. The group that had to “lose” their toppings paid more in total. Possessing something, even if just figuratively, triggers emotional responses in customers. In other scenarios, mechanisms such as trial periods and free samples give customers ownership of the product before buying. Therefore when they do make a purchase, they act in a way to avoid loss, and this increases their willingness to pay.

4. The decoy effect

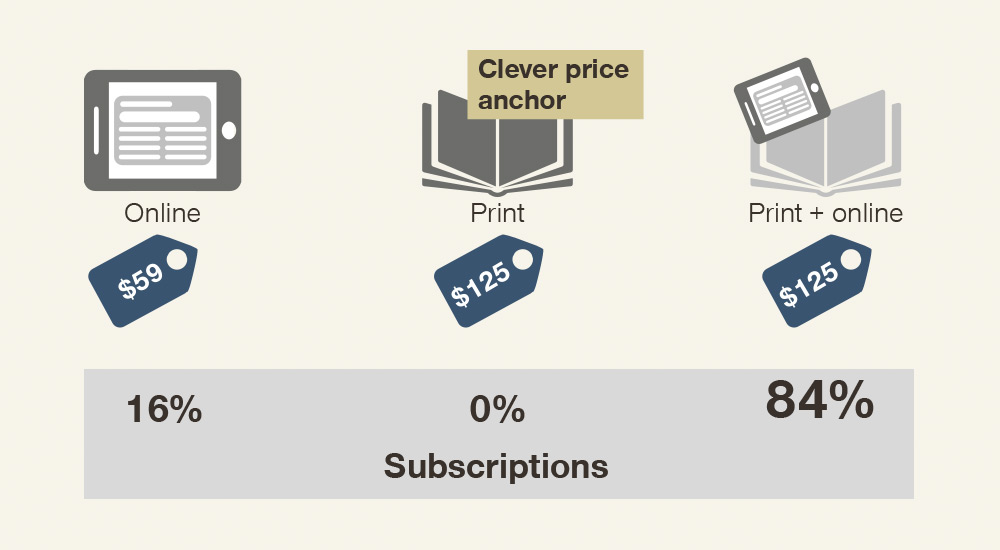

Sometimes it even makes sense to offer a product you actually don’t want to sell, and which nobody wants to buy. This is especially effective for upselling bundles. For example, a newspaper offering “online only” and “print+online” subscription packages recognized that the majority of its readers opted for the less valuable, online-only package. However, when they added the decoy “print only” product for the same price as “print+online”, the popularity of the more valuable package dramatically increased. If one price option clearly dominates another, it is easier to make a decision based on an existing reference point. Creating inferior dummy options as such reference points within your offering nudges the customer toward the more valuable product or package.

5. The value effect

Now imagine you are on a beach on a hot day and want a beer. A friend offers to bring you one from the only nearby place where beer is sold. This could be either a fancy resort hotel or a small run-down grocery store. What is your willingness to pay for the beer from each place? You are likely willing to pay less for the store-bought beer, and more for a beer from the hotel. Customers are willing to pay a higher price for a comparable product if they think this is acceptable. Make your product the resort hotel. This an important value creation task. Explicit recallers such as specifying uses and risks, or using pictures and other cognitive support help customers to understand the value that the product can have for them.

Enjoyed reading our article? Good news: This popular series is available as A Practical Guide to Pricing! Download our free eBook now and learn how to achieve a sustainable, competitive advantage through pricing!

Read more from our expert blog series Pricing Basics:

Part 1: The Importance of Pricing

Part 2: Pricing Power, and How You Can Profit From It

Part 4: Value Pricing Changes the Rules of the Game

Part 5: Digital Transformation – A New Way of Working

Part 6: Price increase? No problem. Preparation beats price pressure!

Part 7: Stay Strong – How to Fight a Price War

Part 8: Skimming or penetration pricing?

.jpg)