The gaming industry underwent significant developments during recent months – but which trends are going to last? Our experts think: the continued rise of gaming subscriptions is a sure bet. The insights from our just recently carried out Simon-Kucher Global Gaming Study support this assessment.

Unlike many other industries, the gaming sector is currently flourishing. Gamers are investing more time and money into gaming during the COVID-19 crisis, and this trend is going to last even after the pandemic ends, according to the Simon-Kucher Global Gaming Study, which surveyed more than 13,000 people in 17 countries (Australia, Brazil, Canada, Chile, China, France, Germany, India, Indonesia, Mexico, Netherlands, Spain, Singapore, Thailand, Turkey, UK, USA) during the months of May and June.

We wanted to know, what will the needs of gamers be? And what are smart ways for game publishers and developers to satisfy them? Based on our study insights, we predict that subscription models will heavily impact the future of the video gaming, as gaming subscriptions are appealing to gamers of all types.

Industry players need to understand that there is a huge likelihood for subscription services to become a predominant way consumers access games, and based on our findings, will also increase gaming’s share of a valuable asset – consumers’ time. Therefore, subscriptions will compound stellar industry growth rates already amplified by the COVID-19 crisis, but time is of the essence to capture market share and become established contenders, particularly in countries where penetration is currently low.

3 different kind of gaming subscriptions

First of all, what are we even talking about when discussing gaming subscriptions? Simply put, a game subscription service is a video game monetization model where users pay a recurring subscription fee to access a library of video game titles. This differs from the traditional video game model, where games are bought and sold individually, either in disk form or as digital download, and users would retain ownership over each title. For the most part, there are three different ways users can subscribe to gaming services:

- A subscription to one game (e.g. MMORPGs like World of Warcraft)

- A subscription to a game console’s online services (e.g. PlayStation Plus)

- A subscription to a platform that offers games from different publishers (e.g. Apple Arcade, or Microsoft Game Pass)

In our study, we mainly concentrated on the potential of the third category.

Quality, number, and diversity of games are the key buying criteria

Video game subscriptions that offer access to a library of playable (and even downloadable and shareable) games are a relatively new offering from video game publishers and providers. In our study, we found that over one in three gamers globally report already buying at least one gaming subscription, and that the critical aspects of a subscription that drives their choice are the quality, number, and diversity of games included in the subscription. Among gamers who play more than five hours per week, the price of the subscription is the third or fourth most important driver. These preferences are similar to other media subscriptions, such as for TV, where we also see that quality and freedom of choice are the driving factors from a consumer perspective – not the price. Knowing this, publishers should highlight these criteria in their communication.

Casual gaming segments are largely untapped so far

35 percent of gamers already using a subscription is a promising figure – but we are convinced that there is still room to grow. Our study found a substantial market for gaming subscriptions among casual gamers (playing five or fewer hours per week). This target group is motivated by similar standards of game quality, but are more price conscious than moderate and serious gamers. At the same time, only a few providers are actively targeting this customer segment. Market entrants such as Apple Arcade have seen limited success in accessing this market, but our study validates their objective: Casual gamers report spending an average of 18 US dollars per month on video games; casual gamers who buy gaming subscriptions spend 33 dollars on average per month. Given the appeal of subscriptions that offer a library of games attractive to both serious and casual gamers – imagine a “Netflix of Games” – gaming subscriptions will be best positioned to address the different needs of these segments.

Number of subscribers expected to rise

Our opinion is that the concept of offering a wide selection of games for different tastes and abilities, which we dub “Netflix of Games,” is the optimal strategy for successfully establishing a gaming subscription. Not only because of our insights mentioned above, but also because these kind of subscriptions are a cross-sectoral trend. More and more people live a subscription life: Thanks to the so-called sharing economy, consumer tendencies are shifting towards renting rather than owning – this is the case when it comes to cars, bikes, movies, music, and so on. This especially holds true in the entertainment industry as nearly everything nowadays is subscription-based, with Netflix, Spotify, and Audible as well-known examples. It’s not a wild guess that this development will spill over to gaming.

New offers like the release of the 2020 Xbox will likely make subscriptions even more popular among the gaming community. Xbox, for example, offers a monthly financing bundled with their gaming subscription, Game Pass, which makes it especially attractive for a consumer segment that probably isn’t willing to spend four to five hundred dollars upfront for a console, plus more for games, but does have a budget for lower monthly recurring spending. This low upfront-commitment is appealing for many consumers, and publishers and developers need to keep this in mind.

Gaming subscriptions are not a winner-take-all market

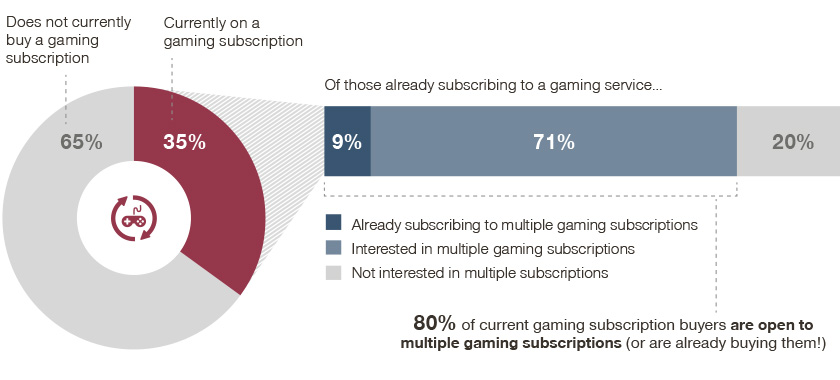

While an increasing amount of gamers signing up for subscriptions is good news for the industry, the competition is also rising. Our study finds that when it comes to gaming subscriptions (similar to on-demand TV and Movies), it’s not likely to be a “winner-takes-it-all” market where one subscription provider creates such a strong customer loyalty that it discourages the consumer from trying other subscriptions. We found that nine percent of gamers already buy multiple gaming subscriptions, while another 71 percent are open to trying multiple subscriptions in the near future. In total, 80 percent of gamers surveyed are interested in more than one subscription! Just as the disruptive effect of Netflix and Amazon Prime served to normalize the concept of watching movies and TV shows on-demand and to have multiple subscriptions, gaming subscriptions are tapping into a consumer preference for greater choice and flexibility.

Infographic: 80% of buyers of one subscription use or are interested in more

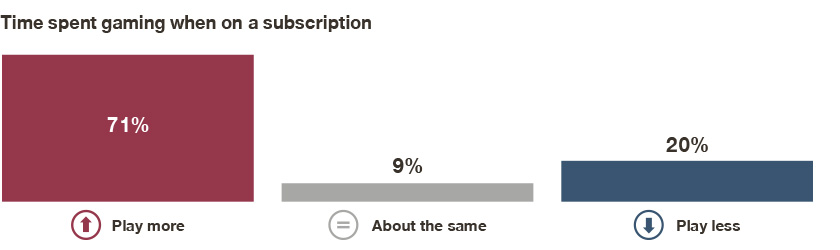

In addition to normalizing video games as a form of entertainment, subscriptions may be tapping into a similar mindset that drives an increasing consumption (bingeing) of on-demand TV: 70 percent of gamers report playing more when buying a gaming subscription. We are already seeing providers rushing to better address the market using existing customer loyalty to introduce usage of gaming subscriptions, such as Apple One that bundles Apple Arcade into a larger subscription offering. Exploratory offers from additional subscription providers (e.g. Amazon Luna) herald an era of increasing focus on consumers looking to venture into gaming subscriptions.

Infographic: 70% of gamers report an increase in their gaming time when on a gaming subscription

Untapped willingness-to-pay for gaming subscriptions

How can the industry profit from these insights? The monetization opportunities are there, providers and publishers just have to find strategies to tap into them. Serious gamers (playing 20+ hours per week) would spend 19 to 40 dollars per month for their ideal gaming subscription, and even casual gamers (playing fewer than five hours per week) are willing to spend 10 to 30 dollars per month. Such a wide willingness-to-pay range reinforces the possibility of multiple providers competing for the wallet of the modern gamer.

It also reveals the potential for publishers to offer additional benefits via tiered or premium gaming subscriptions. Few providers currently target the high end of the price range. Companies interested in growing this segment should look into introducing limited or early-access features (e.g. AAA titles available in the premium subscription within a short time, akin to Disney+’s premier access). For example, the new Xbox Game Pass: Due to its cost of up to 35 dollars per month for a hybrid of games and hardware, is still within the budget range for most gamers. Given that the willingness-to-pay for a monthly subscription without the hardware is up to 40 dollars, this leaves room for including additional premium offers.

Microsoft’s Xbox and Apple are early trend-setters of two pricing models for hardware and gaming: ongoing commitments (vs. one-time upfront purchase) and bundled subscriptions. As additional providers follow suit and offer competitive offers, consumers can look forward to greater choice and flexibility in their access to games.

Is the cannibalization risk exaggerated?

Overall, publishers find subscription models financially attractive since they create recurring revenue streams and an ongoing opportunity to articulate the value of additional services and premium content. However, they should also consider the risk of a stronger shift towards subscriptions, which may reduce gamers’ willingness to spend more than 50 dollars on flagship gaming titles in the future. As it was with music subscription services like Spotify, early adopters tended to be those that already spent a lot on music. People now using it are more price conscious, and often use it as an opportunity to save costs overall. That’s why publishers like Sony don’t want to include their premium titles in subscriptions, because they feel that it is not a sustainable monetization strategy for games in that price range.

However, in our opinion, even though there is a cannibalization risk, in the longer term there is too much at stake for publishers who decide to wait and see. We expect that the market for flagship titles will evolve like it has for movies, where they are only included in subscriptions after they have been available for purchase separately for a while. This will help to maximize revenues over the lifetime of a title.