Building on ongoing in-depth discussions with leaders in the medtech industry, our 2023 China Medtech Outlook is now out, with key themes highlighted in the article below.

Policy drivers: The positives and negatives

In September 2022, China unveiled a subsidized loan scheme amounting to 200 billion yuan (RMB) for hospitals to build up their hardware. This bodes well for medtech companies, especially in diagnosis, imaging, pathology, ICU, rehab, and clinical research. In fact, many medtech companies have reacted quickly to the new policy and launched various products and services to fully capitalize on it.

Meanwhile, volume-based procurement (VoBP), import substitution, and payment reform remain recurring themes that will continue to shape the industry going forward.

- Results from the third round of national VoBP for spine orthopedics were released in September 2022 and show three noteworthy trends:

- Broad coverage and lasting impact: The third round of national VoBP had a broad coverage of more than 90 percent of the national volume for artificial spine consumables, with a contract period of three years

- More rational tendering rules: Manufacturers were separated into three groups based on volume and provision capability, and a safeguard mechanism was applieFd to discourage irrational bidding; as a result, a product can win if its bid is lower than 40 percent of the highest bid from the same group

- High winning rate: Out of 173 companies that joined the third round of VoBP, only 21 failed to win any bids and will be out of the competition for the next three years. Therefore, the competitive landscape remains largely undisrupted, in contrast to the dramatic outcomes of pharmaceutical VoBPs

- Against the backdrop of global supply chain challenges and geopolitical tensions, import substitution is putting additional pressure on multinational companies:

- At the national level, public hospitals are required to source 137 types of medical devices entirely domestically, including orthopedic surgical and laparoscopic instruments, medical ultrasonic instruments, and medical lasers. Additionally, public hospitals must source 25 to 75 percent of their stock of another 41 types of medical devices from domestic producers, impacting a wide range of medical device and consumables companies

- Many provinces have followed national guidance and issued their own provincial regulations on the management of imported medical equipment. For example, Zhejiang requires public hospitals in the province to prioritize domestic products in procurement, except in the case of 195 specific types of medical equipment

- The healthcare payment reform to implement diagnosis-related groups (DRGs)/the big data diagnosis-intervention packet (DIP) continues:

- The National Healthcare Security Administration (NHSA) plan requires a full rollout of DRGs/DIP across all hospitals, all disease types, and all basic medical insurance (BMI) categories by 2025

- Following this, NHSA announced its intention to advance the reform in 32 pilot cities, including implementing DRGs in 18, DIP in 12, and both DRGs and DIP in two. Many pilot cities have already released their implementation plan

- Shanghai, as a pilot city for both DRGs and DIP, has released a three-year plan aiming to cover all hospitals, all types of diseases, and 70 percent of BMI spending for urban employees by 2022

- Payment reform will fundamentally change the procurement model of hospitals. The effects on the medtech industry will not only be reflected in price pressure, but also in access and reimbursement

Market access: Poised for changes

Early access

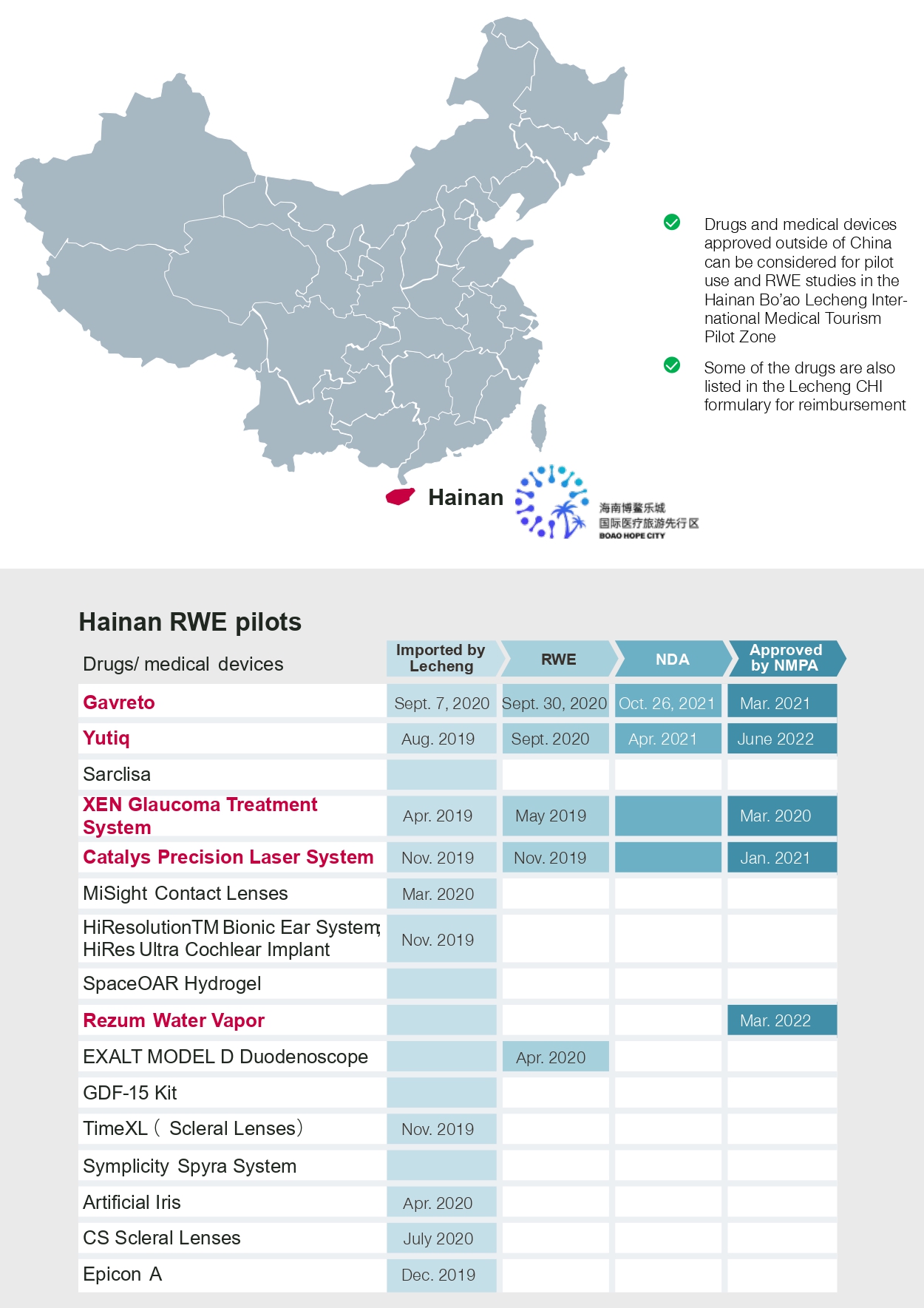

Hainan Bo’ao Hope City and Medicine Connect in the Greater Bay Area are providing accelerated pathways for early access to innovative devices before they receive approval from the NMPA.

- The city of Bo’ao in Hainan province has been embracing innovative pharmaceuticals and medtech devices and has even granted early access to them for medical practitioners in Hainan. As of 2022, HiRes ultra cochlear implant was the latest such innovation to receive approval in Bo’ao before receiving NMPA approval

- Early access in the Greater Bay Area through Medicine Connect resulted in four successful cases where medical devices were offered after one year of implementation. In February 2022, the second imported drugs and medical devices formulary was released, which included another six drugs and one medical device

- Early access in Hainan and the Greater Bay Area will afford more opportunities for innovative products to become established and help accelerate the regulatory process

New funding levers

Several new funding levers to improve affordability for innovative therapies are emerging. Among them, city commercial health insurance policies (city CHIs) and innovative payment programs in some regions are developing rapidly:

- City CHIs are becoming increasingly popular in China’s medtech market. More and more city CHIs are including medical devices in their formularies; these devices include Optune, an irradiation treatment for glioblastoma, which is included in over 30 city CHIs, an insulin pump in Qingdao and Dongying CHIs, and a deep brain stimulation device in Dongying CHI

- Innovative payment programs intended to improve affordability for patients have recently emerged in some regions, and some of them are providing coverage for breast prostheses, implantable pumps, intraperitoneal meshes, and other treatments

For example, Shanghai and Beijing provide different reimbursement schemes for robotic-assisted surgeries, and Shanghai recently launched outcome-based reimbursements for septin 9 testing, tumor cryoablations, brain arterial embolectomies, and transcatheter aortic valve replacement (TAVR). These models may facilitate the growth of such innovative but expensive procedures in China.

The future of basic medical insurance

BMI is the largest funding source for medical devices, including those developed through medical software development. While coverage is mostly offered at a local level currently, reforms to establish a national reimbursement medical device list (NRMDL) are in progress:

- As stated in the Pilot Plan to Ramp up Medical Services Reform, the Chinese government aims to take a gradual approach to separating medical devices from medical service items and to establish a national reimbursement formulary similar to the national reimbursement drug list (NRDL). The main obstacles to achieving this are the complexity of medical device categorization and the many stock keeping units (SKUs) to consider

- The unique device identifier (UDI) developed by the NMPA and the generic medical device name (GMDN) developed by the NHSA could provide the foundation needed to establish the NRMDL

Winning in China’s medtech industry

Based on our extensive analyses of the latest trends, we believe there are three key strategies to succeed in China’s dynamic medtech environment:

- Systematically assess the policy environment and market dynamics

- Proactively adapt to ongoing changes and challenges

- Vigorously innovate across the product portfolio, go-to-market approaches, and business models for differentiations and competitive edges

- Product differentiation:

- Example: AK Medical, a major local player in orthopedics, shifted its offerings toward 3D printing for customized orthopedic products, which experienced a revenue increase of 303 percent in 2021 and helped to minimize the impact of VoBP on its more commoditized offerings

- GTM approaches:

- Example: GE Healthcare has been striving to integrate its different technologies in ultrasound, interventional surgery, and nuclear medicine with healthcare providers in China and has been venturing into artificial intelligence for better clinical decision support for healthcare practitioners where unmet needs are most salient

- Business model innovations:

- Abbott has been partnering with physicians, patients, pharmacy chains, and digital health platforms in China to enhance digitalized blood glucose monitoring around its FreeStyle Libre Sensor, with the long-term goal of building a real-time disease management system for diabetes patients. In the process, it has been effective at differentiating itself from conventional devices and offerings and is starting to establish high value perception and brand loyalty among patients and caregivers alike

- Product differentiation:

With the dynamic situation in China’s medtech space, agility and innovation continue to be the key themes among those aiming to win in the industry.